[ad_1]

Shares of Chinese language expertise firms are promoting off at dwelling and overseas this week because the nation’s ties to Russia add to investor uncertainty on the expense of China’s tech trade. China can also be enduring a COVID-19 outbreak, resulting in mass lockdowns in expertise hubs, and a few of its main expertise issues wish to convey their listings again to home shores on account of regulatory stress.

The dimensions of the current drop within the worth of Chinese language equities was dubbed “panic promoting” and “relentless,” for context. In numerical phrases, the Hong Kong Grasp Seng Index fell greater than 5.7% as we speak, reaching a brand new 52-week low; the Shanghai Composite fell 5%, additionally a 52-week low.

The Alternate explores startups, markets and cash.

Learn it each morning on TechCrunch+ or get The Alternate publication each Saturday.

In case you are parsing the public-market carnage this morning, you would possibly count on that Chinese language enterprise capitalists would pull again their funding cadence. In spite of everything, when the market’s threat tolerance flips, we regularly see extra conservative conduct from cash managers, proper?

Perhaps.

One key shock in 2021 was the truth that regardless of a regulatory barrage from the central authorities, Chinese language startups had a reasonably good 12 months when it got here to elevating capital. You’ll have been forgiven for anticipating the other. In spite of everything, the size of the 2021-era regulatory crackdown on Chinese language tech firms was one of the necessary expertise tales final 12 months, resulting in an enormous reshuffling of not solely financial energy within the nation, but in addition the place non-public capital flowed.

Declines

If we tracked a number of days of declines within the public markets after which requested what influence the market motion had on historic enterprise funding, we’d sound a bit foolish; near-term public market actions don’t influence trailing private-market outcomes. However the current declines within the worth of Chinese language equities are extra continuation than new motion, so we are able to take a look at Q1 enterprise capital information and do some little bit of compare-and-contrast.

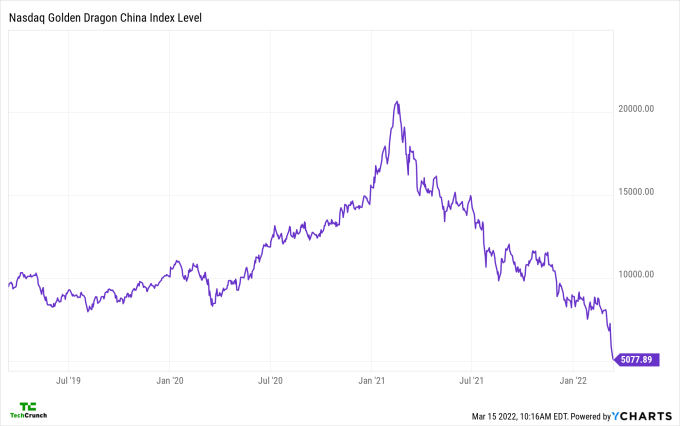

On the historic declines level, the NASDAQ Golden Dragon China Index tracks the worth of U.S.-listed firms with a “majority” of their enterprise “throughout the Individuals’s Republic of China.” And oh boy is it a scorching mess. I’ve by no means seen a chart fairly like this one:

Picture Credit: YCharts

You may see a transparent pattern from early 2021 to as we speak, together with the current selloff that has brought on such a stir.

Including up our information up to now: Chinese language equities are taking body-blows as geopolitical, regulatory, and pandemic-related uncertainty led buyers to race for the exits. And, much more, the valuation declines that we’re discussing aren’t a brand new phenomenon, however might as a substitute be thought of an acceleration of prior developments (see above chart).

So are we, eventually, seeing a deceleration within the tempo of Chinese language enterprise capital?

Perhaps!

[ad_2]