[ad_1]

This weblog targets entrepreneurs within the FinTech business who’ve a mortgage lending app growth thought.

If we have a look at the choice lending market that consists of various mortgage choices aside from older financial institution mortgage choices, the transactional worth of the lending market is about to succeed in $344,421 million in 2022.

Now, this can be a big quantity and clearly reveals the potential to put money into cash lending app concepts.

On this weblog, you’ll study

- Tips on how to create a cash lending app?

- How a lot does it price to develop a mortgage lending cellular app?

- What are the superior options to incorporate in on-line mortgage lending apps?

Conditions to Begin Cash Lending App Enterprise

Having an app thought to construct a custom-made cash lending app resolution is nice, however earlier than understanding find out how to create a cellular utility, it’s important so that you can know in regards to the stipulations to comply with. The next listing will provide help to to maintain issues so as.

| Conditions | Rationalization |

|---|---|

| Enterprise Registration Kind | Select find out how to register a authorized entity. Should you register your enterprise as an organization or LLC (restricted legal responsibility firm), you’ll shield your enterprise towards collectors in case of any pressure majeure or chapter. |

| Register Your Enterprise Entity | Choose a required service and enroll as an entrepreneur. Observe all the federal government necessities and register your enterprise with a singular title. For instance, if you wish to set up your enterprise within the USA, register it with uspto.gov. |

| Safe Preliminary Capital | You’ve three choices to safe preliminary capital, we have now defined it right here.

|

You already know the stipulations to initiating your cash lending enterprise, subsequent test the step-by-step process to construct the cash lending app.

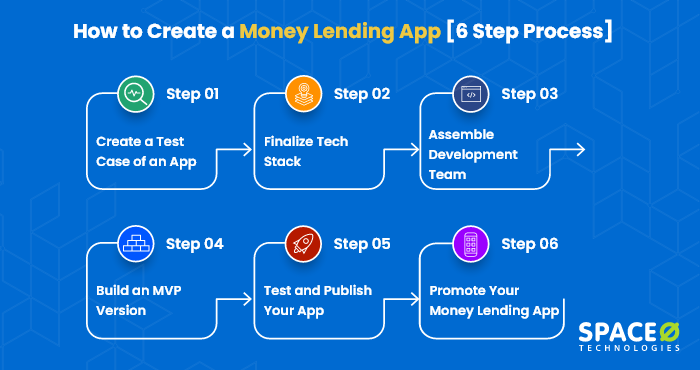

Tips on how to Create a Cash Lending App [6 Step Process]

After taking these factors into consideration, listed here are the 6 steps course of of cash lending app growth you’ll want to comply with.

-

Create a Check Case of Your Cash Lending App Concept

Having a cash lending app thought is step one to contemplate within the mortgage app growth course of. Subsequent, you need to have a group who’s nicely versed in finance and understands all of the legal guidelines of the area. After understanding all the foundations and rules, create a check case of your cash lending app growth thought consisting of three components.

- Prospects

- Rivals

- Business

Together with preserving these 3 components in thoughts, carry out detailed market analysis about your cash lending app. Listed below are the steps and an evidence to test efficiently carry out market analysis.

| Steps to comply with | Rationalization |

|---|---|

| Competitor Evaluations |

|

| App Options |

|

| Analyze Enterprise Itemizing Web sites | Set the filter based on enterprise classes, articles, and relevance. By doing this it is possible for you to to know what your rivals are offering of their utility and their monetization technique. |

One other key component to recollect is to construct your mortgage app from a futuristic standpoint. It is advisable take into consideration the functionalities, applied sciences, and scalability. Because the calls for will enhance sooner or later, you’ll be chargeable for scaling your cash lending app with the newest options and functionalities. Moreover, test totally different concepts to construct a private finance app efficiently.

Need to Validate Your Cash Lending App Concept?

Contact us. Guide a free session with our skilled app growth group to get worthwhile data.

Finalize the App Improvement Tech Stack

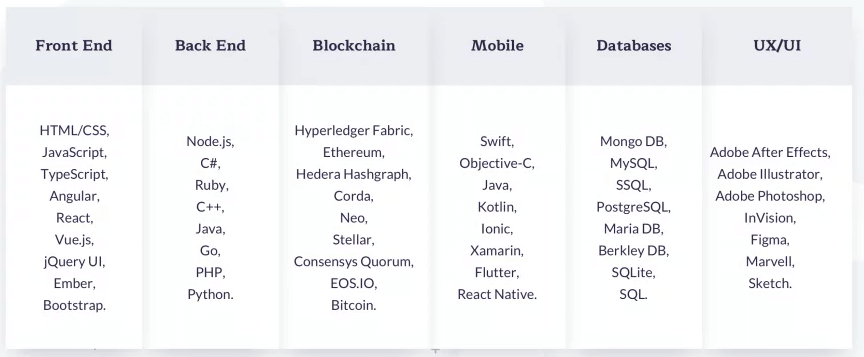

Selecting the best tech stack is vital to construct scalable cash lending apps. Because the expertise is scaling quick, the complete app lending course of has change into easier and extra dependable than it was earlier than.

The beneath picture reveals the listing of applied sciences which can be used for internet and cellular app growth. FinTech functions use these applied sciences to construct their cellular functions. This tech stack is just not restricted to solely constructing cash lending apps however covers the complete FinTech business.

Even utilizing the newest expertise stack, we have now constructed 2 well-known FinTech apps for our shopper. Take a look.

FTCash is an organization that facilitates digital funds and gives loans to small and micro-businesses. FTCash additionally acquired $140K in pre-series A fundraising from the IvyCamp platform on March 3, 2016, based on the Financial Instances.

PayNow for Stripe is an easy point-of-sale instrument that allows you to settle for bank card funds utilizing Stripe proper out of your telephone. The app has helped generate 35 occasions ROI, achieve greater than 50,000 customers, and likewise ranked third within the prime revolutionary app class.

After efficiently selecting the best tech stack, the subsequent step is to type a group of skilled FinTech app builders.

Assemble a Workforce of Skilled FinTech App Builders

To develop your cash lending app efficiently, rent a devoted group, on-site group, or comply with a hard and fast worth mannequin or hourly worth mannequin relying upon your venture necessities.

Nonetheless, it’s best to assign the venture to skilled firms with previous expertise in constructing FinTech associated cellular app options. Due to this fact, the beneath entities are required to finish your cash lending cellular app growth venture efficiently.

- Workforce lead

- UI/UX

- Entrance finish builders

- Again finish builders

- iOS and Android builders

- QA specialist

- Venture supervisor

Being a reputed cellular app growth firm, we have now greater than 200 skilled builders who’ve constructed greater than 4400 cellular apps. The following step will likely be to construct an MVP model of the app.

Construct an MVP model of the Cash Lending App

As Eric Ries, a widely known American entrepreneur quotes, “A minimal viable product is a model of a brand new product that permits a group to collect probably the most quantity of validated buyer studying with the least quantity of effort.”

Start making ready the MVP after you’ve chosen a group on your venture. Product MVP is a must have for anybody who desires to method the creation of a brand new utility with warning and logic. It helps you keep away from a whole lot of errors and gives you a bonus over those that, in most conditions, construct the complete product instantly.

- Initially, test the viability of your utility with out investing a lot of your effort and cash. In case your viewers is just not excited by your app, then you’ll remorse over-investing. Nonetheless, by constructing MVP initially, you should have the benefit of constructing the complete product instantly.

- You’ll know whether or not or not individuals want your product, and if that’s the case, for what and the way they’ll put it to use. You’re going to get fast suggestions to optimize your app accordingly.

- By growing an MVP model, you’ll perceive what’s working and the modifications you require on your cellular app. By receiving adverse suggestions, the core a part of your cellular app could change. Nonetheless, that is the higher possibility, and you’ll perceive what’s in demand proper now.

- If the MVP launch goes nicely, you’ll begin getting cash and gaining purchasers lengthy earlier than the complete model is prepared. You’ll see a fast return on funding and find customers who usually tend to change into common clients because of this.

As well as, individuals could not want a number of the options that you simply deliberate to spend so much of effort and time on. Ignoring these options will provide help to cut back price and time and help you concentrate on what your viewers wants probably the most. After the MVP growth ends, the step will likely be to check and publish the appliance.

Carry out Thorough App Testing and Publish Your App

Your job doesn’t finish after constructing the MVP model of the app. It’s important to check your cellular app strategically to make sure its superior high quality output. Listed below are a number of the check strategies to comply with.

| Parts to Check | Rationalization |

|---|---|

| Automation | Automation integration is important to extend app effectivity. It additionally helps to extend product high quality and reduce handbook effort. |

| App Safety | Private knowledge safety monitored compliance and excessive API safety needs to be examined. |

| Knowledge Integration |

|

| Performance |

Functionalities needs to be examined utilizing a regression testing technique. Anticipated app functionalities akin to account opening, invoice fee, and deposits course of ought to work seamlessly. |

| Efficiency Testing | Whereas making use of for loans, some instantaneous mortgage apps crash; this can be a signal of poor app testing. Your app mustn’t crash even whereas having an rising quantity of consumer base. |

Promote Your Cash Lending App

After efficiently testing your cellular app, launch your app. Now, the query involves how nicely you promote your utility? What steps will you are taking to market your cellular app? To reply your questions, listed here are 3 methods to market your P2P cash lending app.

-

Promote an App by way of Touchdown Web page

-

Social Media Advertising

-

Content material Advertising

Design a touchdown web page with intuitive design and interesting content material to drive most conversion on your lending app. Even an internet site is a necessary instrument for producing high quality leads on your cash lending app. Design a easy but intuitive touchdown web page to get most publicity from customers.

To get inspiration, test the web sites of main cash lending companies within the USA, akin to Incomes and Dave.

There are 3.78 billion social community customers the world over. Furthermore, 65.3% of Individuals are about to make use of digital banking by the yr 2022. Fb, LinkedIn, and YouTube consist of a better consumer base, the place you possibly can promote your cash lending app.

In a ballot of worldwide entrepreneurs carried out in mid-2019, 91% of respondents said that content material advertising and marketing was already getting used as a part of their promotional actions. For instance, weblog submit creation, video advertising and marketing, eBook writing are some methods to advertise your model in addition to your app to the end-user.

Your finish aim needs to be to monetize your cash lending app efficiently. By having sufficient finance, it is possible for you to to scale your enterprise.

We mentioned find out how to create a cash lending cellular app, subsequent, you’ll study authorized compliance and encryption-related factors.

What Are Authorized Compliance and Encryption?

When you have determined to go fully-fledged along with your mortgage apps enterprise thought, you need to take some precautions to keep away from fines and penalties. Even it’s important so that you can shield your app from malefactors. So by making use of the next factors, you possibly can simply shield your app from hacking, knowledge breach and safe your cellular app.

| Compliance and Encryption Factors | Rationalization |

|---|---|

| Seamless Working of App | Builders want to contemplate P2P lending apps to be fault-tolerant. It can work uninterruptedly even when a heavy load resulting from a lot of simultaneous operations could happen. Due to this fact, it’s required for a developer to make use of instruments that may deal with fault tolerance. |

| Prioritize Safety | Combine biometric authentication and two-factor authentication. Other than that, make use of APIs to safeguard consumer knowledge. To maintain your app secure from fraudulent actions and cybercrime the connection from the P2P platform to servers needs to be encrypted. |

| GDPR Compliance | In case you are launching mortgage apps within the EU (European Union) market, making a GDPR compliant app is essential. This regulation turned formally efficient on Might 25, 2018. Should you don’t wish to be fined, you need to comply with these steps to make the lending course of seamless. |

| CCPA Compliance | The intention of the California Shopper Privateness Act (CCPA) is to safe customers’ non-public knowledge for California residents. It’s mandatory for the customers to have complete authority over their private knowledge. CCPA turned official on Jan 1, 2020. Due to this fact, if California is your goal market, it’s important to make your cellular mortgage app CCPA compliant. |

After understanding authorized compliance and encryption strategies, the subsequent step is to know in regards to the growth price of the cash lending app.

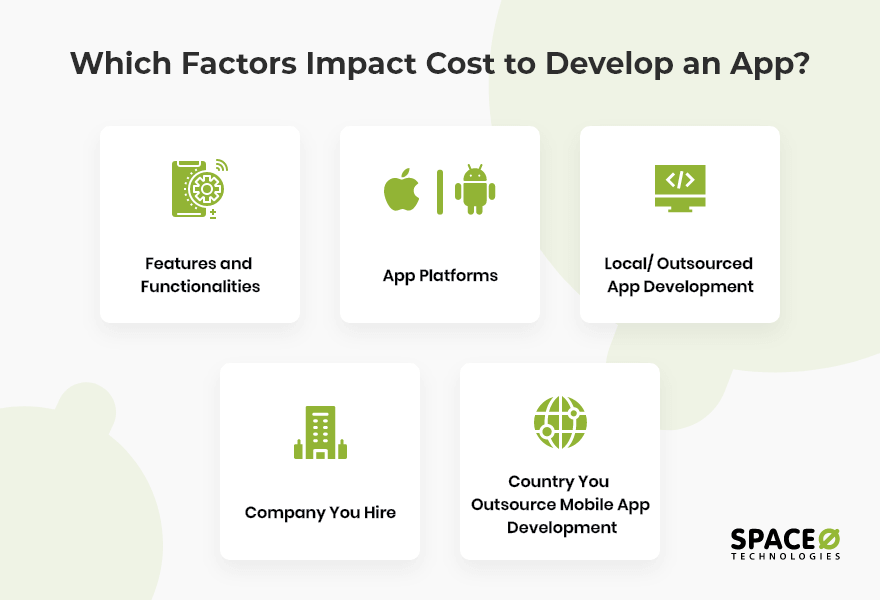

How A lot Does It Price to Construct a Cash Lending App?

The price to construct a cash lending app could vary between $25,000 to greater than $1,00,000 relying upon components akin to app functionalities and options. To know extra, test the beneath picture that mentions the components instantly impacting the app growth price.

How Lengthy Does It Take for Cash Lending App Improvement

After discussing the associated fee, subsequent we have now curated an estimated timeline to construct a cash lending app.

| Cash Lending App Improvement Course of | Estimated Man Hours | |

|---|---|---|

| iOS | Android | |

| Wireframing | 40 hours | 40 hours |

| Design | 45 hours | 45 hours |

| SRS | 35 hours | 35 hours |

| Check Case | 30 hours | 30 hours |

| App Improvement | 220 hours | 220 hours |

| Backend Improvement | 160 hours | 160 hours |

| App Testing | 40 Hours | 40 Hours |

| Complete Hours | 570 Hours | 570 Hours |

This isn’t the tip of the schedule for cash lending app growth. We’ve additionally offered a tough timeline primarily based on the various types of academic apps.

| Prime Options of Cash Lending App | Estimated Man Hours | |

|---|---|---|

| iOS | Android | |

| Mortgage Administration | 52+ Hours | 52+ Hours |

| Fee and Billing | 40+ Hours | 40+ Hours |

| EMIs and Transactions | 52+ Hours | 52+ Hours |

| Withdrawals and Switch | 170+ Hours | 170+ Hours |

Need to Develop Customised Cash Lending App Answer?

Discuss to us. Share your P2P cash lending app thought with our app guide and our skilled group will provide help to to construct a custom-made resolution.

What Key Options Does A Cash Lending App Have?

In line with Statista, 31% of customers count on to have an choice to take and submit footage of key paperwork whereas processing the mortgage paperwork. Other than this characteristic, listed here are the 7 cash lending app options it’s essential to combine whereas growing your utility. As well as, the desk accommodates superior options and its rationalization.

| Superior Options | Rationalization |

|---|---|

| CIBIL Evaluation | To use for private loans or enterprise loans, you require a CIBIL rating to not less than go nearer to 900 factors. The nearer your rating is to 900, the upper your probabilities of getting approval to take loans. |

| Dynamic Requirement Gathering | Your mortgage app should be capable to generate doc necessities after inspecting mortgage traits dynamically. It will simplify the mortgage utility and approval course of. Consequently, it can prevent time and vitality whereas permitting you to finish the method shortly. |

| Chatbot Integration | This characteristic will permit debtors and lenders to speak by means of in-app messaging with out exchanging contact data. |

| Restructuring of Mortgage | PayPal and different cellular funds – this manner, customers can have totally different choices to decide on how they wish to pay their mortgage or curiosity. |

| Fee System Integration | Your utility should combine with totally different fee strategies akin to PayPal, financial institution debit, and bank cards. This fashion, customers can have extra flexibility to pay as per their selection. |

| Reward Factors and Rankings | If debtors and lenders pay the quantity with rates of interest on time, they are going to be awarded extra factors. Thus, it can make your app dependable for the end-user and enhance trustability as nicely. |

| AI-based Analytics | Customers and admin will profit from real-time analytics. As well as, the admin can have the proper to test platform operation utilizing AI and massive knowledge applied sciences. |

We’ve got mentioned superior options, subsequent test the highest examples of mortgage lending cellular apps.

What are the Effectively Identified Examples of Cash Lending Apps?

We’ve got listed the cash lending cellular apps you need to take inspiration from. In case you are looking for extra concepts, test the listing of finest FinTech apps to get some inspiration.

We’ve got mentioned one of the best examples of cash lending app, subsequent learn the FAQs individuals ask previous to growing cash lending app.

FAQs About Tips on how to Create a Cash Lending App

-

What kind of growth mannequin to decide on for the cash lending app?

To make your lending growth venture cost-efficient, you need to select the proper growth mannequin on your venture. The beneath desk illustrates 2 sorts of fashions and their explanations.

Improvement Kind Rationalization Rent Product Improvement Workforce When you’ve the thought and the funds however not the group to develop it into an actual product, this can be a nice possibility. Relating to product creation, the expertise accomplice you rent should be capable to deal with the complete course of, from idea to design, coding, launch, and persevering with product assist. Rent a Devoted Workforce Generally you’ve the in-house expertise to begin growing an app, however you possibly can’t scale shortly sufficient or discover the specialists you’ll want to hold the venture transferring ahead beneath tight deadlines. This is the reason using a specialised group is the best method for fast entry to the required expertise and guaranteeing that software program growth and scaling comply with the accredited roadmap. -

How do mortgage cellular apps work?

Mainly, customers who require to borrow cash have to comply with the below-mentioned process to make the app work.

- Set up the appliance

- Login with present data or register with a brand new account

- Add the sum you require for the mortgage

- Choose the rate of interest based on the sum you’ve added

- Join your financial institution accounts to the mortgage utility

- Full the process

As quickly because the process completes, you’ll obtain an e mail and textual content message of the quantity and rate of interest you’ve been granted a mortgage.

-

Must you develop a mortgage utility in a local or cross-platform?

Construct your mortgage app within the native. As a result of you’re going to get distinctive efficiency, safety, in addition to your app will work seamlessly, which is able to give a really feel that your app is an inbuilt a part of your cellular.

Construct Your Customised Cash Lending App

We’ve got lined stipulations, step-by-step app growth procedures, authorized, and compliance. Other than that, you’ve obtained a solution to the incessantly requested query of how a lot does it price to develop a mortgage app price, options, examples. Additionally, FAQs are included on this weblog that can assist you to know in-depth details about the cash lending app.

Constructing a cash lending app growth course of is cumbersome. Nonetheless, by following this information, you’ll certainly be capable to achieve constructing a custom-made cash borrowing app on your FinTech startup.

Being a widely known cellular app growth firm for the previous 11 years, we have now expertise growing custom-made cash lending cellular apps.

Guide a session with one in every of our tech consultants and validate your thought to succeed at your enterprise.

[ad_2]

![Tips on how to Create a Cash Lending App [Process + Cost] Tips on how to Create a Cash Lending App [Process + Cost]](https://www.spaceotechnologies.com/wp-content/uploads/2022/02/How-to-Create-a-Money-Lending-App.png)