.png#keepProtocol)

[ad_1]

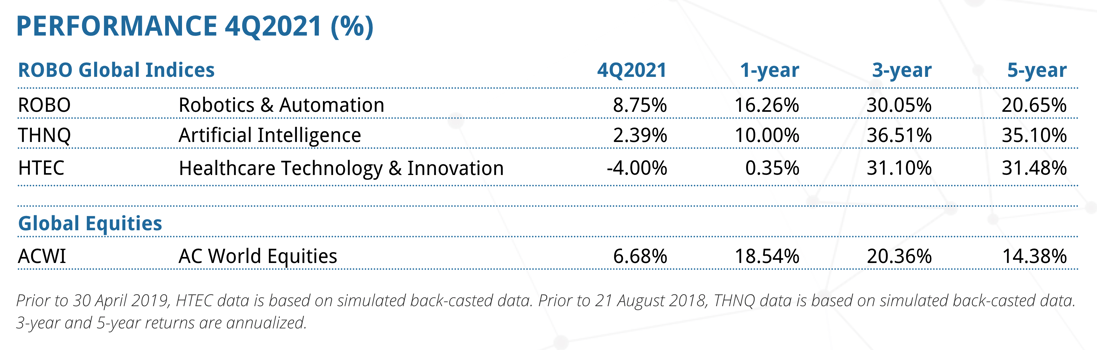

The Robotics & Automation Index (ROBO) weathered the sell-off in lots of disruptive expertise shares: It outperformed world equities and rose 9% in This fall, to shut the yr 2021 up 16%. The Synthetic Intelligence Index (THNQ) was up 10% in 2021, and the Healthcare Expertise & Innovation Index (HTEC) was flat, after each indices rose greater than 66% in 2020. Whereas traders debate the near-term development and inflation outlook, we stay targeted on the innovators and market leaders driving these expertise tendencies. On this report, we talk about key developments and large movers throughout our innovation portfolios.

Webinar Transcript:

Jeremie Capron:

All proper. Good morning, everyone, and welcome to ROBO International’s January 2022 Investor Name. My identify is Jeremie Capron. I am the director of analysis. I am speaking to you from New York. And with me on the decision, my colleagues and analysts from the analysis crew, Nina Deka and Zeno Mercer. So we lately printed our annual tendencies analysis report, which you’ll find on our web site. It is at roboglobal.com. And at this time we’re very excited to current a few of the key expertise tendencies that we’re watching on this new yr and the way they relate to our three innovation index portfolios. That is ROBO, the robotics and automation index, HTEC, H-T-E-C. That is the healthcare expertise and innovation index. And THNQ, that is T-H-N-Q, the substitute intelligence index. And we shall be taking your questions. So really feel without cost to kind them into the Q and a field.

Let me begin with a couple of remarks available on the market and our outlook for this yr. Our view a few yr in the past that 2021 can be a growth yr that has largely performed out. In reality, the worldwide financial rebound has continued. There’s loads of momentum regardless of the renewed COVID-19 waves and flare ups within the US and the remainder of the world with new variants, however I feel extra importantly for traders in expertise, the pandemic has been a really robust catalyst for the digital of the economic system and our view that robotics AI, as a subsequent expertise revolution, this view has performed out at an accelerated tempo over the previous two years. So give it some thought. We have all needed to make adjustments to our lives. Our work lives, our private lives when it comes to how we work, how we store, how we examine, how we entertain ourselves. And most of those adjustments they have been about adopting extra digital expertise and extra automation. And from the perspective of companies, corporations have additionally needed to adapt and the place have they been investing? They’re digitizing, they’re deploying automation and AI at a report tempo. And proper now the bottleneck is the scarcity of staff, which we are able to see throughout a lot of the Western world in China as nicely.

Within the US alone, we have seen the variety of unemployed staff again to the pre-COVID ranges of simply round six million. And within the meantime, we have seen job openings which can be searched to greater than 11 million. That is a virtually 50% enhance from the pre-COVID ranges. Regardless of the trigger is, the quick reply from corporations is productiveness. And we consider that this may proceed to supply a powerful tail finish for automation and AI when it comes to the demand for options round that. After which ’21 was a yr of shortages. Not solely of staff, but in addition semiconductors. We have seen important disruptions in provide chains. So basically you’ve gotten a constraint provide facet and on the identical time, you’ve gotten very robust client demand. And so inflation has turn into a priority. We have seen inflation reaching multi-decade highs and that has triggered considerations round curiosity for charges.

And prior to now few months, traders have been apprehensive about potential hit to financial development because of this from tighter financial situations, tighter fiscal coverage. And so we noticed very brutal transfer in a few of the most speculative areas of the fairness market in current month. We have seen many shares which have had extraordinary returns within the restoration from the COVID lows, giving again loads, if not all of their video games. And I feel this consists of many so-called disruptive expertise shares. So for those who take a look at the NASDAQ, the NASDAQ is down about 8% from the excessive, however beneath the floor, there’s greater than a 3rd of the shares within the NASDAQ index which can be down greater than 50%. They have been reducing half.

And I need to transfer to the subsequent slide right here. The excellent news is that our innovation portfolios usually are not overly uncovered to such lengthy period shares. And by lengthy period, what I imply is corporations which can be loss making, however anticipated to make important income a number of years out into the long run. And in reality, one of many key pillars of our funding technique right here at ROBO International is diversification. And so whereas we take the long-term view and we construct index portfolios with corporations which can be positioned to profit from the expertise revolution within the long-term, the index development methodology is predicated on a really disciplined system. It is a self-discipline scoring system to pick the expertise and market leaders and likewise self-discipline weighting system that avoids focus. And focus could be very painful as we’ve seen in current month. So once we take a look at our index returns right here on the desk, we’re fairly happy with the efficiency of ROBO, and THNQ, and HTEC, and their resilience on this difficult market. In reality, for those who take a look at ROBO within the fourth quarter, the ultimate quarter of 2021, ROBO was up slightly below 9%. It closed the yr up greater than 16%. And over the previous three years, we’re taking a look at 30% annualized returns. So fairly passable right here. And you’ll see on this secure that the three analysis pushed methods have largely outperformed world equities over the previous three and 5 years.

Okay. Now let’s speak about robotics and the tendencies that we’re watching. After which I am going to go it on to my colleagues to debate healthcare expertise and AI. However first, I need to present this long-term efficiency chart of the index. And once more, that is an index that is greater than 84 corporations proper now. They’re the very best in school robotics and automation corporations from all all over the world. And you’ll see right here the outperformance over time, which is mostly a reflection of this ongoing expertise revolution, the exponential development of automation and autonomous programs in just about each sector of the economic system. On this subsequent slide, you’ll be able to see that’s what we seize with index. The core enabling applied sciences on the left facet like sensing, and computing, and actuation. After which on the best hand facet, essentially the most promising purposes. And that covers manufacturing unit automation to eCommerce logistics. You possibly can see healthcare, meals, and agriculture, and so forth.

So when it comes to particular tendencies that we’re being attentive to this yr, I want to begin with robots coming to save lots of the availability chain. Everyone knows concerning the pandemic associated provide chain disruptions, however one other actual necessary issue right here is the dramatic rise in eCommerce volumes. And there is ever shorter supply occasions that customers now count on. And that is pushed explosive demand for logistics and warehouse automation. Orders have been exceeding provide capability for materials dealing with tools, autonomous cellular robots, the observe and hint expertise inside the availability chain, the storage system, the retrieval programs.

We expect that the logistics and warehouse automation market exceeded $70 billion final yr. And we predict it should develop to greater than 105 billion by 2025. So a few of the main beneficiaries in our portfolios are corporations like Daifuku in Japan, Zebra Applied sciences right here within the US, GXO Logistics that lately went public. It has very robust presence within the UK. We’re taking a look at AutoStore additionally lately IPOed firm out of Norway, Cardex is in Switzerland. So you’ll be able to see the breadth right here of corporations within the portfolio. And we predict that basically from a expertise perspective, it is the developments in laptop imaginative and prescient, in machine intelligence, in supplies, in sensors which have actually enabled robotics to make a considerable impression on this planet of logistics. At this time, robotic choosing is changing into a actuality and we have seen robotic choosing speeds now exceeding 100 peaks an hour. And that compares to people efficiency simply round 60 to 80 peaks an hour. And so automation right here is relieving staff from checks which can be frankly uninteresting and exhausting and more and more troublesome to seek out staff for it.

And transferring on, I additionally need to spotlight manufacturing unit automation the place we count on to see a surge this yr in 2022. In reality, the world’s main robotic corporations like FANUC, and Yaskawa, and ABB, and KUKA, they’re all ending the yr with very inflated order backlogs. They’ve a powerful visibility into demand for 2022, and we count on that the put in base of commercial robots all over the world shall be simply round 3.7 million. 3.7 million robots by the top of the yr. And but that might nonetheless symbolize lower than 1% of the variety of manufacturing staff all over the world factories.

So one of many largest areas of focus proper now’s collaborative robots. We name them cobots they usually can work seamlessly with people. And there is an instance of that right here on the image within the higher proper nook. Cobots are at this time lower than 5% of the market, however we count on the section to develop by greater than 35% per yr. And meaning a market that might attain 15 billion by 2028. And the market chief right here is Teradyne. And Teradyne occurs to be top-of-the-line performing shares. Within the closing quarter of 2021, the inventory was up 50%. Teradyne is basically a semiconductor testing corporations traditionally. Again in 2015, they acquired Common Robotic and made it the highest participant in collaborative robots. They’ve very robust options for the availability chain and warehouse automation. And the primary 9 months of the yr, Teradyne gross sales in Common Robotic, have been greater than 50% yr over yr.

I feel the third necessary development I need to spotlight right here when it comes to robotics is the rise of autonomous autos. And right here I am speaking concerning the lengthy haul, but in addition the final mile supply. The applied sciences which can be making autonomous autos potential are converging and the associated fee are falling very quickly. You consider sensors, take into consideration AI and the compute energy and communication with 5G now out there. That is driving down the price of items. We expect autonomous autos are very promising when it comes to potential to hurry up deliveries and enhance power effectivity and decrease emissions. So at this time there’s only a small variety of autonomous vehicles and vehicles all over the world. There’s many extra autonomous cellular robots inside factories and warehouses, however on the roads, we’re simply getting began. And in reality, Waymo was the primary firm within the US to launch a completely autonomous taxi service. And it launched in Arizona, however nonetheless had a driver up within the entrance seat. Now, Cruz has simply introduced that it’ll turn into the primary firm within the US to have a full autonomous service with no driver. In order that’s changing into a actuality. We’re taking a look at corporations like Tesla after all, but in addition Luminar, Nvidia, and Qualcomm that present the mandatory expertise to make these programs potential. So Luminar is in lidars, Nvidia is in computing after all, Qualcomm within the umbrella as nicely. Umbrella that has video processing chips and make some nice headway within the auto trade.

Now, China can also be main the way in which there. And we lately heard from Alibaba that they accomplished the one millionth eCommerce supply utilizing autonomous supply robots. And Baidu additionally obtained an approval in Beijing to launch a robotaxi service. So we’re seeing autonomous autos on the roads. We will see extra of them. The suppliers of the important thing applied sciences are going to profit. We’re additionally seeing autonomous autos on the water. Cargo ships. And lately in Amsterdam, we noticed a full autonomous water taxi service begin. And likewise indoor whereas taking a look at indoor drones piloting round that we predict that is an infinite market alternative. So I feel with that, I’ll cease right here and go it on to my colleague, Nina. I might like to ask Nina to speak about healthcare applied sciences.

Nina Deka:

Proper. Thanks, Jeremie. And thanks everybody for becoming a member of the webinar at this time. We actually recognize your curiosity in ROBO International. So HTEC is our healthcare expertise and innovation index. We focus completely on healthcare tech. And it is a portfolio of corporations which can be mainly offering traders with publicity to all of the disruption that is taking place in healthcare, the excessive development corporations over the subsequent 5 to 10 years. So a very thrilling time to be concerned on this area. Though this chart could not essentially point out so within the shorter time period provided that within the full yr 2021, the efficiency … the index returned about 0.4%, however for those who take a look at the long run intervals, for instance, over a 3 yr interval, a again check would present that the index has returned over 30%.

So it is a nice long-term alternative, but in addition a very fascinating time to get entangled in case you are not but concerned or trying so as to add positions as a result of proper now the index is buying and selling at about 6.4 occasions ahead EV gross sales, which is a reasonably discounted a number of given the place it has been traditionally. For instance, final yr, it was extra within the seven occasions vary. So a very thrilling time to get in there. And let me dig in slightly bit about what occurred final yr. In order we’re all conscious, 2021, a key theme that resonated all year long was simply uncertainty. Not figuring out what was going to occur with the economic system, with the pandemic. There was some extent the place individuals thought that we have been popping out of it and that 2022 be normalized after which Delta occurred. And because of this, largely of the Delta variant when it comes to healthcare, procedural volumes have been impacted. Individuals who have been ready to get their knees changed for instance, as soon as once more put that on maintain. And so there was already a backlog of people that doubtlessly would’ve had procedures in 2020 which will have gotten them in 2021 that bought additional delayed. So this impacted loads of healthcare corporations.

Along with that, there’s the brand new healthcare employee disaster, which is healthcare employee shortages. In the course of the pandemic, over 100,000 healthcare staff lives have been misplaced globally. And within the US alone, over half 1,000,000 individuals have left their jobs as a consequence of numerous pandemic associated causes since February of 2020. So all of us already had a healthcare employee staffing scarcity that was rising. It’s going to proceed to develop the hole between individuals coming into the healthcare employee workforce. It appears to be rising as a result of extra individuals are retiring out than individuals are coming in. In the meantime, individuals are dwelling longer. So the demand for healthcare staff within the subsequent 10 years isn’t going to be adequate for the variety of individuals say over age 85 who’re dwelling longer to obtain the care that they want. That dynamic was accelerated within the final yr or two because of the pandemic.

So now as we sit up for 2022, we’re interested by what are some areas which can be actually going to assist this difficulty, which is really a disaster. When individuals speak about healthcare capability, it is not about variety of beds. There are aren’t sufficient beds out there. That is not the difficulty. That is a 2020 drawback. In 2021 and now bleeding into 2022 with the Omicron variant, there’s not sufficient healthcare staff to take care of the quantity of people that want the care. So if we zoom in actually fast to This fall, HTEC was down 4% and it was to those indicators that I simply talked about. The Delta variant, procedural volumes being lowered, additionally considerations round inflation and or rising rates of interest. So all this stuff have impacted tech. And when issues impression tech after which issues additionally impression healthcare, HTEC will see each the confluence of each of those elements. Like I mentioned, nice entry level for individuals who have an interest.

I do need to spotlight two corporations that basically had an incredible efficiency in This fall of final yr. Vocera was up 34%. This can be a firm that gives a fingers free wearable system that’s voice operated. As you’ll be able to see, it is this badge that is worn on the clothes of the 2 healthcare staff. This firm bought loads of consideration through the pandemic as a result of it enabled individuals to speak with their colleagues, their different healthcare staff exterior of the affected person’s isolation room with out having to depart the room, take off the PPE, come again, placed on new PPE. So Vocera actually helps easy effectivity and that is only one facet of what they do. Additionally they provide software program that helps combine all of the medical gadgets within the hospital. And on that well being handhold system, a doctor or a nurse can get all of the updates with out having to go to the affected person bedside.

So given their means to combine and have this underlying software program that form of ties collectively all the gadgets within the hospital. We not solely noticed this as a gorgeous funding alternative, Vocera is a member of not simply HTEC, but in addition of ROBO. It was simply introduced a couple of weeks in the past that Striker, one other firm in HTEC, plans to amass Vocera. And it is a fairly enticing valuation right here. It was about 10 occasions subsequent yr’s gross sales, which is a premium given, nevertheless it was warranted given the sophistication of this firm’s analytics and integration capabilities. We count on to see the funding tendencies towards healthcare, information analytics, and integration capabilities. That is simply early days. Healthcare simply went digital within the final 10 years. There’s nonetheless a significant alternative for lots of disruption right here. So this is only one instance of why, though healthcare tech appears to be like prefer it took slightly little bit of a backseat, there’s nonetheless a lot right here that’s going to be ahead taking a look at loads of upside when it comes to valuation and a number of enlargement.

One other thrilling firm in This fall is Codexis. Codexis returned 34% within the quarter. And so they reported a rise 242% income within the earlier quarter as a consequence of 29 million in gross sales from their partnership with Pfizer. It has been extensively reported that Pfizer has an antiviral treatment for coronavirus for COVID 19. And so Codexis is an organization within the HTEC index that Pfizer partnered with to supply the proprietary enzyme used to make the drug. So I need to spotlight right here that this is only one firm of many within the index which can be enabling loads of expertise and healthcare to maneuver ahead. These enabling corporations are ones that not lots of people have heard about. There’s different examples of it like Moderna and J&J each partnered with Catalent to get their vaccines out the door. And Lonza. Catalent, Lonza, Codexis are all examples of corporations which can be third celebration producers of medicine. And so they present very refined stage of producing capabilities. Take into consideration mRNA. No one had ever heard about it, nicely, exterior of the science group till final yr or the yr earlier than. And now it is a multi-billion greenback enterprise. And it requires a stage of refined to have the ability to manufacture that at scale, and Catalent rose to that event.

So these are simply examples of whenever you see one thing actually cool taking place in healthcare within the information, chances are high these corporations most likely needed to associate with different corporations. And so there’s loads of alternative for funding upside right here. And so actually that is the place for those who’re excited about capturing all that upside potential, a diversified portfolio is likely to be an excellent technique for you. And so that is what HTEC affords. In order we glance ahead now into 2022, I discussed that what we will be-

Erin:

Nina?

Nina Deka:

… keeping track of.

Erin:

Apologies. Can I interrupt you simply actually fast? As a result of we’ve a query to elucidate the large underperformance of HTEC in comparison with world healthcare index. So earlier than you progress into the ahead trying, may you form of deal with that basically fast?

Nina Deka:

Oh, completely. Thanks for the query, Erin. So basically, as I discussed, when healthcare and tech take a success, that may impression healthcare HTEC slightly bit greater than the worldwide healthcare index. So for those who have been to take a look at … And truly we’ve a slide that describes this space with the horizontal bars. When you have been to take a look at the worldwide healthcare indices, the massive ones like S&P, what you may discover is that they are much extra closely weighed in massive cap prescription drugs and hospitals, medical insurance corporations. The explanation why is as a result of these portfolios are cap pushed. They’re comprised largely of huge cap corporations. And the most important cap corporations in healthcare are massive cap pharma and medical insurance corporations. And that may be a very completely different funding technique.

We have now lower than one-fifth overlap with these kinds of portfolios. So throughout a time of uncertainty when individuals are involved about issues like inflation or rising rates of interest, they have a tendency emigrate in direction of a few of the extra worth funding alternatives corporations with rising dividends and corporations with optimistic earnings, optimistic cashflow whereas stable funding alternatives are usually rising within the single digits. And like I mentioned, that is a really completely different funding alternative. When you take a look at the inexperienced bar, the inexperienced horizontal bar, that is the HTEC. In order you’ll be able to see, HTEC is slightly bit extra … very rather more diversified throughout these different areas that we consider symbolize all that technological development and disruption that I used to be simply describing to you. So corporations which can be serving to to fabricate mRNA, corporations which can be serving to to combine all of the medical gadgets in a hospital, 3D printing, surgical robotics, genomics, diagnostics. When you look searching for extra diversified portfolio that is going to cowl these components of healthcare, like I mentioned, that is what HTEC has extra comprised of. Nonetheless, in an atmosphere the place individuals have been extra involved about excessive development tech names corporations that may not have optimistic earnings, however count on you within the subsequent couple of years, these shares over the past yr mainly took a success. And so HTEC noticed the confluence of that.

After which I discussed earlier the extent of pleasure we’ve round corporations offering information, that is information analytics and AI. There’s loads of dysfunction taking place in healthcare proper now. So for those who have been to consider why ought to I spend money on healthcare innovation proper now? I feel one purpose to not make investments is for those who assume healthcare is okay the way in which it’s. If there is no such thing as a healthcare employee scarcity, if every little thing’s fantastic, if there isn’t any remedy associated errors, every little thing’s going easily, then there’s not loads of room for disruption, however we all know that that is not the case. And so a method that we’re going to have the ability to resolve all these issues is thru information analytics and additional integration.

One other actually fascinating firm is known as Well being Catalyst within the HTEC portfolio. That is one other information analytics firm that is built-in with a whole bunch of software program packages all through a hospital system. And so they can analyze a inhabitants in an space and supply information to the hospital and say, “Look, we see an space the place individuals are prone to being hospitalized due to their excessive danger well being state of affairs.” Well being catalyst will assist seek the advice of with the hospital to supply a plan to be proactive and go after the excessive danger inhabitants. And in doing so in a single explicit hospital, they have been capable of assist save $32 million and decrease affected person admissions as a result of simply from figuring out forward of time utilizing analytics and AI to see which of the inhabitants they’ll serve and assist maintain wholesome and forestall the sickness to start with.

One other actually thrilling space that we’re following as I discussed is robotics. Once I speak about how there is a healthcare employee scarcity, one of many ways in which we’re going to have the ability to strategy this and transfer ahead is thru automation and corporations offering healthcare robotics proper now are actually on hearth. There’s one within the HTEC and ROBO portfolio known as Omnicell. Omnicell supplies robots to pharmacists and to hospitals to assist automate the pharmacy course of. If you consider pharmacies at this time, you have bought a pharmacist placing tablets in bottles after which doing a ton of administrative work. And but 90% of pharmacists point out in a survey they cannot discover sufficient assist to do all of the work that is wanted. In the meantime, remedy error is the third main explanation for loss of life in the USA. So we have a problem right here and an enormous alternative for automation. And Omnicell is a very fascinating firm proper now, and they’re additionally rising and did very nicely final yr.

After which one other space we’re actually enthusiastic about is spatial biology. So that is one thing that we predict goes to be the subsequent frontier in genomic science. Subsequent gen sequencing was a very large deal within the mid 2000s onward. We noticed an enormous inflection level there once they began being manufactured and we consider that that is going to be taking place, spatial biology. We count on to hit an inflection level equally within the subsequent yr. And if you would like extra particulars on spatial biology, comfortable to speak about that additional. And we even have particulars about that within the report. I am going to simply say in a short time that what spatial biology does is it lets you have a snapshot of what is going on on, for instance, contained in the physique, like inside a tumor at extra element than for those who have been to simply merely sequence … do the gene sequencing.

When you have been to consider a map, image a map with no streets and no addresses. What spatial biology does is it mainly places the addresses, and the areas, and the constructing numbers on the pattern. And so if you consider that in a tissue pattern, it is supplying you with simply much more element than you’ll’ve in any other case had. And with this, individuals are going to have the ability to develop higher therapies and likewise diagnose most cancers higher and different sicknesses. With that, I’ll pause and truly go it over to Zeno who’s going to speak to you about THNQ, our AI portfolio.

Zeno Mercer:

Thanks, Nina, for masking HTEC. Hey, everybody. At this time I’ll be masking our THNQ index. That is T-H-N-Q. And inside THNQ, we basically try to seize the universe of synthetic intelligence from software to infrastructure from the bottom up. So throughout purposes, we have cloud supplier, community safety, semiconductor. So these are the platforms which can be … and {hardware} which can be offering the manufacturers for the purposes that we now take with no consideration basically to even work collectively. And on the appliance facet, we see thrilling corporations throughout client dealing with eCommerce particularly more and more within the final yr healthcare and enterprise processes is we see cloud adoption throughout corporations. A number of it induced from the COVID pandemic. And moreover, we additionally see manufacturing unit automation. So the assume index had a … we’ll admit it had a tough quarter for the This fall. It was up 2.39% and up 26% on an annualized base since inception. So there was a mixture of elements that contributed to this efficiency. And a few of it being simply fears round tapering and the rate of interest atmosphere impacting a few of the larger development shares. However that being mentioned, we’re seeing the demand for AI and adoption from the community stage, from the appliance stage has by no means been larger.

So we have information coming in from autonomous autos, augmented actuality, all these new platforms which can be being deployed in the actual world truly with actual enterprise features. We have rising the associated fee and power. There is a large demand for sustaining power prices, each on the information middle stage and micro system stage, that may very well be laptops to large information facilities offering AI for drug discovery. After which we have the financial advantages. That it is one factor to contemplate. The AI is altering each trade. There is not a call made at a Fortune 500 firm now that is not pushed now with information and evaluation. After which moreover, that’s getting down into the merchandise which can be being deployed to prospects, each enterprise is and client. Actual fast. Might you go to the purposes and infrastructure web page? Yeah.

So I simply need to spotlight additional on efficiency. So Semiconductor community safety had an incredible quarter. Nvidia and A&D each noticed barely over 40% inventory returns. There have been loads of considerations across the means of those corporations to ship. And a few yr in the past, everybody was form of involved, will they be capable of sustain demand? Will they’ve provide chain points that stop them from earning profits? And the reply is sure. They delivered on all of the above and demand has by no means been larger as elevated purposes and corporations preparing for 2022 and past are using these platforms. Healthcare expertise corporations and large information analytics, as we already mentioned, noticed slightly little bit of a laggard and enormous deployments noticed some pushback. As soon as once more, that is within the 2022. So this impacted. These firm isn’t semiconductor. After which lastly, excessive development FinTech, which is a portfolio, part of our portfolio that we’ll speak about slightly additional on, was hit laborious as comparable considerations round inflation and rising rates of interest. However in the long run outlook, we see huge continued adoption right here.

Now onto the corporate spotlight right here, Arista networks led by CEO, Jayshree Ullal, is a cloud networking supplier that’s powering massive information facilities from Microsoft, Google, Amazon. And basically they supply these networking switches that enable them to speak and run quicker at extra power environment friendly. These information facilities eat loads of energy, lot of compute. This can be a platform that will not be within the information for client product or something. They’re essential, very highly effective. As I discussed, it was as much as 67%. It is a robust cloud atmosphere. And so they raised their expectations to 30% and development in 2022 even with continued provide chain points. So as soon as that subsides, you are going to see much more tailwinds there. After which New Relic, an organization I am certain most of you might be most likely not aware of as a result of it is largely builders and cybersecurity specialists using this, nevertheless it supplies full stack evaluation for each the infrastructure and software, which is essential as a result of loads of gamers on the market simply take a look at one or not the opposite, and you actually require each of them working on the identical time to have the ability to function. Firms like Uber. Simply any firm on the market that depends on huge information units and realtime evaluation and strategies wants any such evaluation.

Take into consideration how your automobile runs. That is only a single atmosphere with sensors. We’re not even speaking about autonomous autos right here. It wants to know how the oil, the fuel and all this stuff are operating. This mainly supplies that, nevertheless it goes past that for a lot larger purposes. One of many causes for his or her huge development within the fourth quarter was they not solely simply beat expectations, however additionally they introduced that they scored a $3.5 billion new buyer, which is among the largest ever. And so they introduced two new merchandise that ought to enhance the acceleration. And now I’ll cowl some tendencies that we’re enthusiastic about going ahead in 2022 and past. So AI machine studying driving the multi-cloud adoption. So what does that imply? As I discussed, whereas front-end purposes get loads of the eye, multi-cloud environments are that center and again layer that empower this transition to the digital world. The objective is to make these interactions as seamless and dependable as potential, regardless of the state of affairs throughout autonomous autos, the metaverse, any autonomous. So if the rising tide is the demand for these companies, then the water actually, the ballot is … that is enabling that is the multi-cloud networking environments. So in the end what it’s best to take away from that is the power to securely share information and retailer information throughout completely different platforms, after which analyze it with completely different companies is paramount as we get into more and more advanced situations.

Gartner truly expects the worldwide cloud market to develop to 402 billion in 2022, which is 35% larger from 2021. So we’re seeing huge development spend right here. And index numbers similar to JFrog, Arista Networks which I simply talked about, MongoDB, and CloudFlare massively profit from this development.

Subsequent subject and development that I need to cowl is subsequent era banking. So banking and finance, as we all know, is reworking. Applied sciences throughout blockchain, digital property, using expertise similar to voice recognition, higher identification, and cybersecurity are serving to automate each backend and client expertise processes. So that is going to supply an enormous transformation to banking companies and remove some overhead, nevertheless it’s actually potential as a consequence of machine studying enabling extra correct predictions danger administration, enabling higher client interactions. So that is going to cowl insurance coverage, fraud, mortgages, cashless funds, digital insurance coverage. There’s actually not an space this is not going to the touch ultimately. And this is not simply theoretical. These are being deployed and utilized proper now out with each personal and publicly traded corporations, similar to THNQ index members, Lemonade, Upstart, Truthful Isaac, and Block, which for those who aren’t acquainted it’s Sq. simply rebranded this previous yr to replicate extra emphasis on blockchain. These are all leaders in digital banking that we’re excited to see develop in 2022 and past.

The final development I need to cowl is form of a mixed a metaverse and immersive expertise. Now this actually impacts all of our indices, however AI is the crux of this. Positive. You may consider simply placing on a headset isn’t actually AI, however you have bought to have the ability to quickly analyze the info coming with laptop imaginative and prescient and sensors. You need to ship that information off someplace utilizing 5G the place it is synthesized and analyzed to supply you actual time content material. So I feel lots of people surprise what’s going to metaverse contact and impression. I feel it is what will not it contact? What’s going to it exchange? Would you relatively have a cellular phone or augmented actuality contact lenses or glasses? Moreover philosophical areas, I feel we are able to all agree we have spent an excessive amount of time trying down at a telephone and touching. So some purposes that we’re taking a look at and enthusiastic about are schooling, healthcare, teaching, video games. These are a few of the extra client targeted. On the opposite facet and equally as necessary, we’re taking a look at manufacturing, and manufacturing, and new kinds of merchandise which can be extra power environment friendly, sustainable, and simply general higher, and safer for the atmosphere. This real-time suggestions and personalised expertise requires immense information units and evaluation and throughput. So index members and semiconductor corporations like Nvidia, Taiwan Semiconductor, AMD are offering loads of the uncooked horsepower right here. However this additionally requires loads of design and purposes.

We have now to basically recreate the digital or the bodily world within the digital world right here to have the ability to perceive it. And so corporations like Adobe, Dassault, Autodesk are powering loads of the innovation right here. For instance, the Dassault is working in numerous completely different fashions, digital digital twins that symbolize your personal physique. So this can be utilized throughout healthcare, throughout simply self-analysis and wellness tendencies, issues like that to offer you a greater snapshot and truly construct software layers on high of that. One other one, for those who take a look at the underside proper nook, you may see a man sporting a headset, and that is a collaboration between two THNQ members, Microsoft and Trimble. And so they’re working to supply frontline staff with a useful helmet with an augmented actuality overlay to get actual time info and communications with out having to make use of one other system. Think about they’re up in a constructing. They do not must be coping with that. It is a seamless overlay. And it is a dwell product now getting deployed, which is unbelievable. In order that being mentioned, I feel we will transfer on to Q&A. Be happy to ask any questions round something we have coated.

Jeremie Capron:

Okay. Thanks very a lot, Nina and Zeno. I see we’ve fairly a couple of questions coming via the field right here. I need to remind everyone be happy to kind your questions in and we’ll attempt to deal with as many as potential. I need to kick off with a few of the questions I’ve seen round investing in corporations with no earnings within the present atmosphere. I feel that is an excellent query. It is actually necessary given the change out there regime that we have witnessed over the previous a few quarters as inflation began creeping up. We’re beginning to see what sort of form the financial coverage responses goes to have. As I mentioned in This fall, This fall was brutal for a lot of so-called disruptive expertise shares, however for those who look beneath the quilt, you take a look at what shares have come down or come crashing down in lots of instances. These are the shares that I might qualify as a few of the extra speculative names on the market, corporations which have very bold plans, and guarantees of earnings which can be very far out into the long run. And within the meantime, they’re burning money they usually’re scaling. The excellent news is that within the ROBO International portfolios, you aren’t going to seek out excessive publicity to these names.

We do personal in these industries some corporations that don’t have any earnings at this time, however they’re the exception relatively than the norm. In reality, and is one thing that we quoted within the annual index evaluate report that we simply printed yesterday, for those who take a look at ROBO, the variety of shares which have an EV to gross sales a number of above 10 occasions is round 15. So there’s 15 shares out of a complete 84 that commerce on a excessive income a number of, and that is indicative of little or no to no earnings. And in order that’s about 20% of the portfolio, however on the identical time, there’s one other 10 shares which can be buying and selling on an EV to gross sales a number of of much less one time. And so that ought to actually make it easier to perceive that the diversification that we’ve in our portfolios. And that is a very necessary pillar of our funding methods for all three thematic indices. And so ROBO truly outperformed world equities in This fall as a result of the hit it took in a few of the larger a number of names was largely offset by the rotation into the extra cyclical and the extra worth areas out there. So in the case of robotics automation, these worth or cyclical areas are usually present in manufacturing unit automation. These are extra cyclical names. It are usually capital items kinds of corporations.

A number of them are in Japan. And the Japan piece of ROBO portfolio is essentially underperformed within the first a part of final yr and it is beginning to catch up. In reality, in 2021, our Japanese holdings have been flat yr over yr when the index itself was up 16%. We’re not overly involved about what’s taking place when it comes to the rotation within the fairness market now. We expect the indices must be comparatively resilient. I feel Nina can touch upon the variety of corporations that aren’t worthwhile at this time in a healthcare expertise and innovation in that provides you with additionally an excellent sense of that. Nina, can you are taking over right here?

Nina Deka:

Completely. Yeah. So about 33% of the businesses in HTEC usually are not but worthwhile, however once we analyze corporations, we’re searching for a transparent path to profitability or some kind of clear path to income. When you take a look at the HTEC portfolio, a lot of the corporations commerce on a a number of of EV to gross sales or perhaps a a number of of EBIDA. So we’re taking a look at both there basically the funding alternative there may be in development or additionally in some kind of clear path towards money circulation, which we consider EBIDA can be the illustration of that. Yeah. The overwhelming majority of the businesses do have earnings. And so we do really feel that that’s pretty de-risked from a expertise and innovation basket standpoint.

Jeremie Capron:

Thanks, Nina. I see loads of questions associated to the index and portfolio development methodology, the rebalancing technique and the weighting of constituent. So I’ll begin off right here and ask Nina and Zeno to remark as nicely. However basically what we do right here is we mix the advantages of lively analysis when it comes to deciding on finest in school corporations to specific our bullish view on the themes. That is the primary a part of the work. And it implies loads of evaluation and scoring of each firm in our universe. After which we mix that with the advantages of index investing, the assorted funding autos that may observe indices when it comes to the chance administration, when it comes to having a quarterly rebalancing to keep up that changed equal weighting throughout the portfolio all through the time and never for an extended time period.

So the result’s that you’ve got diversified portfolios as a result of the weightings for every constituents are usually someplace between 0.8% on the low finish all the way in which as much as 1.8%. And since we stability each quarter, we reset the weights to that rating pushed weighting. And that signifies that the index will promote the most important winners on the finish of the quarter or in direction of the top of the quarter and can purchase the most important losers, assuming that these corporations proceed to attain very excessive on our methodology and that we need to personal them for the long run. In order that form of embedded danger administration course of actually permits us to keep away from a few of the largest pitfalls in disruptive expertise investing. And as we noticed in current month, this may be very painful if you find yourself overly concentrated in a handful of names or in a single very explicit subset of the theme.

I feel an incredible instance of that’s what occurred with gene enhancing and genomics generally. I feel Nina can touch upon that. We have had a very phenomenal yr for genomics in 2020 with some large developments and basically confirming the feasibility of utilizing the CRISPR expertise, for instance. After which final yr, these genomic socks and CRISPR particularly got here to earth when it comes to for reconnecting with the worth of the underlying fundamentals. So Nina, why do not you touch upon the gene enhancing and precision medication generally? I see we’ve a couple of questions round that too.

Nina Deka:

Positive. So I did not truly see what the questions have been. I need to ensure that I do to them. So if I do not reply them, be happy to reprompt me once more, however basically final yr or the yr earlier than, I discussed earlier mRNA as a chance. We have solely now seen one kind of mRNA therapeutic come to market and turn into commercialized. There are such a lot of others presently within the pipeline. In reality, Moderna, one other firm within the HTEC portfolio, had over 20 completely different therapies within the pipeline earlier than the pandemic even occurred. And what we have seen traditionally is when a brand new therapeutic modality has success, then adjoining corporations or different candidates which can be in scientific trials or pre-clinical, we are likely to see optimistic motion adjacencies to these shares as nicely. However we significantly like Moderna as a result of they have been the lead when it comes to the variety of different candidates in scientific trials.

So earlier than the pandemic, they have been engaged on a vaccine for HIV, for Zika, for CMV, which continues to progress. It is in part three proper now. And now that one has come to market, that complete modality has been de-risked. And so that may be a optimistic catalyst for mainly each different mRNA remedy that individuals are engaged on proper now. I additionally need to level out from Moderna that they are very quickly engaged on a flu vaccine and this may very well be recreation altering. They need to rapidly carry one to market by kind of following standard methodology, bringing mainly a traditional flu vaccine to market. What meaning is that yearly the WHO supplies a listing of what they consider the subsequent yr’s flu strains are going to be. And pharma corporations want eight, 9 plus months to fabricate this drug and produce it to scale in time for the flu season for every hemisphere. Effectively, that is an extended lead time. And sometimes, the strains which can be predicted to be the dominant strains of the flu season do not wind up being the case. And that is why we do not see a ton of efficacy round flu.

Moderna is engaged on mainly a recreation changer perhaps within the subsequent couple of years. They need to have one as a result of it solely takes them a few months to get a drug via scientific trials or a minimum of to show that it really works. And so if they’ll get a flu vaccine permitted that solely wants a few month lead time, then they’ll truly develop one nearer to flu season and it might need a lot larger efficacy. This may very well be recreation altering for the entire healthcare trade for the entire world often because a whole bunch of 1000’s of individuals die from the flu. And ultimately they plan to mix that with COVID and have a mixed vaccine and perhaps even embody RSV, one other vaccine that they are engaged on, however tons of different issues are taking place.

I discussed earlier spatial biology. Precision medication is an space the place therapies are being developed to deal with very particular genetic mutations. And for those who can establish, “Okay. This is the gene the that is inflicting this most cancers.” You possibly can provide you with a remedy to deal with that very particular most cancers. With spatial biology, you too can decide how efficient a drug could be as a result of you’ll be able to see different genes close by that may intrude with a drug’s means to be efficient and truly provide you with an much more personalised formulation, if you’ll, or a extra personalised remedy. This can even be recreation altering as we glance to the long run and count on medication to get increasingly personalised. That is going to be enabled by corporations like Roche and different firm in our portfolio with all of their developments. After which there is a ton occurring when it comes to early most cancers detection. Over 10 billions of {dollars} have been invested in M&A for early most cancers de detection in liquid biopsy within the final couple of years. So a very thrilling area there. The market is predicted to be nicely over $30 billion and other people can have the chance sooner or later to doubtlessly detect most cancers before they in any other case would’ve been. And an estimated a 100,000 lives per yr within the US alone may very well be saved with earlier most cancers detection and far higher all over the world.

Jeremie Capron:

Thanks, Nina. I see we’ve a couple of questions on AI. So I’ll invite Zeno to talk one or two and deal with them.

Zeno Mercer:

Hello, Everybody. Yeah. I noticed a pair questions round … a pair questions and feedback. Somebody commented, “Any person predicted this again within the day.” You’ve got bought questions like, “Why hasn’t AI or metaverse predictions … why have they did not materialize?” And one of many issues that I need to level out right here is there is a saying, individuals are likely to overestimate what could be completed in a yr and underestimate what could be completed or 5 and 10 years. And I feel what we’re seeing right here is that individuals noticed the imaginative and prescient of loads of this stuff. As soon as computer systems have been round, as soon as individuals realized that there may very well be one thing that may additionally assume and make actions and selections, individuals theorized that we’d be getting thus far. Perhaps not precisely how, or when, or all these issues, however there’s all the time predictions. And we’re truly seeing loads of this stuff come to mild proper now, as I discussed. We have the metaverse, we had Google glasses, I overlook, over a decade in the past now at this level for a pair little purposes manufacturing, it wasn’t there but. A number of the, we’ll name it the weakest hyperlinks. The power to supply smaller pixels, extra clear screens. There there is a confluence of supplies, {hardware}, power effectivity, which is large. The chip and power effectivity for the shape issue.

A number of that is simply progress by progress. Every incremental innovation stacks on to supply an innovation some other place. A extra power environment friendly battery permits a drone that usually could not have flown round, to be a client drone to test issues round. That is immediately possible. And so switching again to the metaverse and the purposes, we’re on the tipping level now. 2022 as we predict it to development, it is taking place. Now, it may begin extra in larger danger larger areas simply form of within the movie trade. The movie trade, they historically filmed aerial views with helicopters. So the primary place to undertake drones was the movie trade as a result of there was an apparent worth with the low danger of adoption. And in order that being mentioned, we’re seeing that now the identical factor, manufacturing. Different excessive danger areas which have an enormous drawback to unravel, nevertheless it’s trickling down. You’ve got bought Fb, AKA, Meta. Their glass is to report your occasions in your life. And in order we get to every stage, you are going to have heads up shows that just about anybody can have.

College students might need glasses that the lecturers monitor and as an alternative of separating bodily schooling and schooling itself, you may be capable of having them work together, and visualizing, and taking part and you will get extra personalised expertise in schooling for teenagers across the globe. You do not have to be within the classroom anymore when you’ve gotten that immersive expertise. So we’re simply going to see this huge transformation and funding into these areas.

Any person additionally requested about geographies. Even on our portfolio, loads of our portfolio weighting is in the USA. There isn’t any query. A lot of the innovation throughout all of our portfolio indices are popping out of the US. A a lot of analysis comes out of universities, corporations, it trickles up. Clearly although robotics and AI, we’re taking a look at Japan, and China, and different areas as nicely. Nice concepts innovation come from wherever, however we’re nonetheless closely weighted within the US for that.

Jeremie Capron:

Okay. Thanks very a lot, Zeno. And I’ll thank everyone for becoming a member of. We’re operating on the hour simply now. So we’ll wrap it up. Thanks very a lot in your curiosity in ROBO International. You possibly can go to our web site, roboglobal.com if you wish to join biweekly publication through which we share a few of our analysis from corporations, and tendencies, and the indices that we construct. And with that, I want everyone an excellent day. And we sit up for speaking to you once more very quickly. Goodbye.

[ad_2]