[ad_1]

The colocation knowledge heart sector is characterised by exceptional value stability—exceptional in that such exterior pressures as a world pandemic, geopolitical uncertainty, and regulatory restrictions have did not dramatically sway costs in a single course or the opposite.

To make sure, there are typically short-term actions, however over the span of a number of years, collective charges shift solely slowly from their baseline.

Let’s delve into the important thing facets of colocation pricing.

Colocation pricing fashions can differ from one supplier to the following. With a purpose to handle this complexity right here, we monitor particular metrics based mostly on a narrowly-defined situation in an effort to guarantee related comparisons.

Worth per Kilowatt

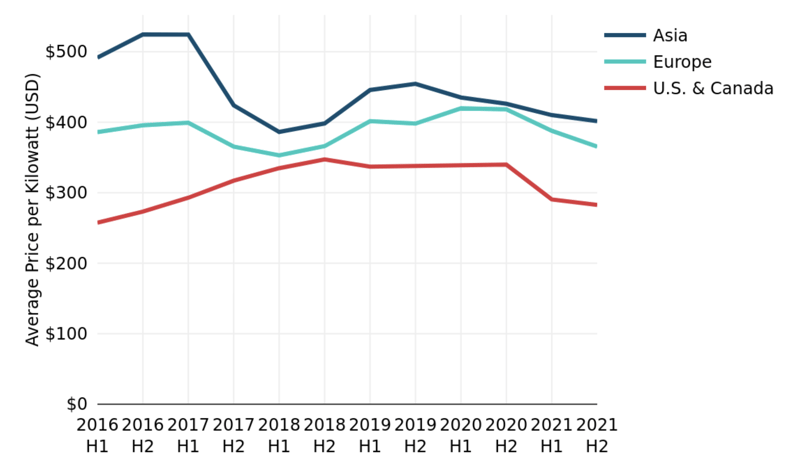

Let’s begin with a broad evaluation of regional value tendencies over time.

Not like lots of the community companies that we monitor at TeleGeography, the colocation market doesn’t comply with a trajectory towards continuous value erosion.

Not like lots of the community companies that we monitor at TeleGeography, the colocation market doesn’t comply with a trajectory towards continuous value erosion. In combination, regional common colocation charges stay regular.

Regardless of the periodic fluctuations within the line chart beneath, the one important regional shift we see is a 6% compound annual contraction within the common value per kilowatt for key Asian metros (measured since H2 2016).

By comparability, long-term modifications for our sampling of key U.S. and European markets are negligible. In truth, the slight shifts which might be proven can typically be attributed merely to sampling modifications.

Sampling modifications significantly have an effect on the current decline proven right here for Europe, the place most operators have reported no pricing change over the previous yr, except a couple of which have truly reported charge will increase.

Regional Common Month-to-month Worth per Kilowatt at 4-Kilowatt Density, H1 2016-H2 2021

Notes: Depicts modifications in common month-to-month value per kilowatt for a 4-kilowatt density cupboard over the desired time interval. Full energy utilization on the specified density stage is assumed for all pricing depicted. Confer with knowledge deliverable file for full knowledge set. Supply: TeleGeography, © 2022 TeleGeography

Whereas general costs are usually fairly steady, regional averages can differ considerably.

Since we first began monitoring colocation pricing in 2013, the typical charge in Europe has usually fluctuated between 20% and 30% increased than the typical charge in North America.

You may discover that there was an anomalous narrowing of this hole in 2018, however regional variations have since reverted to the standard development. Additionally be aware that Asia’s regional common has dropped to close convergence with Europe’s regional common charge however stays barely increased.

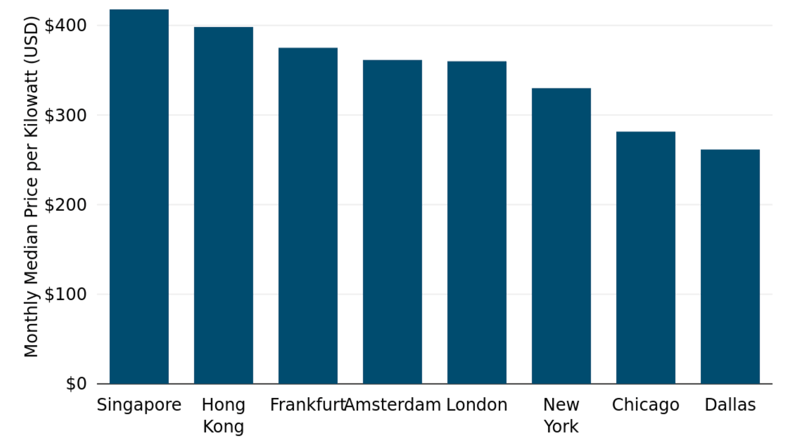

Regional value variations do not at all times translate to particular person markets, however in H2 2021, we had a reasonably neat sample in world hub markets.

As you possibly can see within the accompanying bar chart, Asian hubs had been the priciest, as is often the case. Each Singapore and Hong Kong hovered round median retail colocation charges of $400 per kilowatt.

However mirroring broader regional tendencies, our high European metropolitan markets ranked collectively as the following most-expensive markets, adopted by U.S. hubs. In truth, each U.S. market with ample knowledge for reporting in H2 2021 registered cheaper median colocation charges than in every of our hub European and Asian markets reporting.

Median Month-to-month Worth per Kilowatt at 4-Kilowatt Density, H2 2021

Drilling down additional to intra-regional market comparisons, it is commonplace to seek out important and constant value variations between hub markets throughout the identical area.

Take Frankfurt and Amsterdam, as an illustration. Whereas each are counted among the many greatest telecom and knowledge heart hubs in Europe, Frankfurt has been resolutely dearer—except close to convergence right here in H2 2021. This result’s affected by sampling modifications, however a number of operators persistently cost extra in Frankfurt than in Amsterdam.

The historic value variations between these metros might be seen as an indicator of upper demand and/or increased underlying prices in Frankfurt. Nevertheless it may also be seen as a chance for operators in Amsterdam to compete for regional interconnection demand on account of its relative price-competitiveness.

Amongst different examples, you will discover an analogous sample for those who examine the East Coast U.S. metros of New York and Washington, D.C.

Whereas we’re evaluating market tendencies, what about hub and secondary markets? Do hub colocation charges at all times come at a premium?

Because it seems, whether or not a metropolitan market is taken into account a hub or secondary market would not have a lot of an influence on its pricing.

Because it seems, whether or not a metropolitan market is taken into account a hub or secondary market would not have a lot of an influence on its pricing.

In our H2 2021 market sampling, hub markets had been, on common, about 10% dearer than secondary markets. Usually talking, native aggressive dynamics are pushed by much more than simply the scale of the market.

So what about native pricing dynamics inside particular person markets?

WAN Discussion board members can hold studying this evaluation over right here.

And there is a lot extra intel to be present in our Information Heart Analysis Service and WAN Geography Benchmark instruments.

[ad_2]