[ad_1]

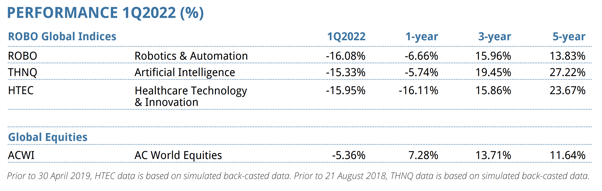

The Robotics & Automation Index (ROBO) declined 16% in Q1, marking the third-worst quarterly efficiency since inception and leaving best-in-class robotics and automation shares 19% under their all-time excessive of November 2021. The Healthcare Know-how & Innovation Index (HTEC) additionally dropped 16%, and the Synthetic Intelligence Index (THNQ) was down 15%. Whereas fundamentals stay sturdy throughout the board, valuation multiples have compressed below the burden of the quickest charges of inflation in a long time, leaving the valuations of the ROBO World innovation indices in step with long-term historic averages. On this report, we focus on key developments and large movers throughout our innovation portfolios.

Jeremie Capron:

Good morning all people. And welcome to the ROBO World April, 2022 investor name. My title is Jeremie Capron. I am the director of analysis, and I am speaking to you from New York the place we have now a wonderful spring day. With me on the decision, my colleagues and analysts from the analysis group, Nina Deka and Zeno Mercer. So let’s check out the agenda for immediately’s name, which is broadcast stay and might be out there as a replay on our web site roboglobal.com. We’ll begin with a quick reminder of what we do right here at ROBO, after which some ideas across the current market improvement. After which we are going to have a look at every of the three index portfolios, ROBO, HTEC, and THNQ. After which lastly we’ll be taking your questions. So be happy to sort them into the Q&A field on the backside of your display. So let me kick off right here with this overview of ROBO World.

We’re a analysis and funding advisory firm that is centered on robotics, AI and healthcare applied sciences. And eight years in the past, we put collectively a group of funding professionals and trade specialists to create analysis primarily based funding methods round what we consider to be the subsequent know-how revolution. And immediately there’s round $4 billion US in funds monitoring our methods, primarily in ETFs right here on the New York inventory alternate in addition to in Europe and Asia. And probably the most notable index is ROBO, which was the primary robotics automation technique, and that began about eight years in the past in 2013. And you may see right here on the display that we additionally run THNQ, T-H-N-Q, that’s the synthetic intelligence index and HTEC, H-T-E-C, that is the healthcare know-how and innovation index. And you may see that yow will discover the annualized returns because the inception of every technique as of the tip of final month, March, 2022.

So these index portfolios mix analysis with the advantages of index investing and the ETF wrapper. They’re composed of greatest in school corporations from world wide. They’re small, mid, giant cap that we analysis and we rating on numerous metrics to find out if they’re included and at what weighting. After which we rebalance each quarter. So the result’s portfolios which have a really low overlap with broad fairness indices, just like the S&P 500 or the NASDAQ or different world fairness industries. And on the subsequent slide, I wish to present you the way we began with ROBO that covers all the robotics and automation worth chain and the bubbles you see round it characterize the sub sectors of focus. So we have now key areas of software like manufacturing facility automation, logistics and warehouses, healthcare, meals and agriculture, and so forth. And likewise the enabling applied sciences that make automation potential like sensing and computing.

And in 2018, we began two further index portfolios round areas that actually stand out by way of their potential disruptive influence. And so THNQ an HTEC or designed utilizing an analogous recipe to ROBO by way of the sub-sector strategy and the analysis work. So let’s speak slightly bit concerning the market and the primary quarter returns. Within the first quarter, equities had one of many worst begins to a brand new yr on file, and we noticed some restoration in March. We had inflation ramping up the very best ranges in 40 years, we had a significantly extra hawkish fed. We now have a geopolitical catastrophe in Ukraine, we have now rising commodity costs. It was a fairly robust order to say the least, and there was no place to cover as bonds additionally dropped arduous. So on this context, our index portfolios underperformed through the first quarter. We noticed declines starting from 15 to 16%, as you may see right here on the display.

The necessary factor that I wish to let you know about this decline is that it was completely pushed by compression in valuation multiples, particularly within the areas which can be most delicate to the financial cycle. And we’ll get again to that. So the 15 to 16% decline corresponds to a 15 to 16% compression within the valuation versus a discount within the gross sales and revenue outlook for the businesses within the portfolios. The truth is, the earnings estimates for index members in combination haven’t come down, they’ve remained steady and even marginally elevated over the previous three months. Now, after all, we’re coming into the earnings season and we are going to see how resilient margins and profitability will be within the face of quick rising prices. And it seems like shopper demand, particularly right here within the US, is slowing after some extraordinary energy up to now 18 months.

However the actuality is that after this 25 to 30% decline from the highs, our three portfolios are actually buying and selling on valuations which can be primarily again to pre pandemic ranges and so they’re additionally in step with the long run historic common valuations that we have seen over time. And within the meantime, I feel the outlook for robotics, for AI, for healthcare applied sciences is considerably improved relative to earlier than the pandemic. And it’s because this pandemic has been a really sturdy catalyst for the digitization of the economic system. It has been an accelerator for automation and within the present surroundings of rising inflation and shortages, we have now shortages in semiconductors, we have now shortages in transportation, we have now a scarcity of employees after all. On this context, enterprise leaders are deploying automation at a file tempo. And the excellent news is that our portfolios aren’t overly uncovered to lengthy period shares.

What I imply by lengthy period is corporations which can be loss making at present however anticipated to generate vital income far into the long run. They don’t seem to be that a lot of these corporations within the indices. One of many key pillars of our funding technique is diversification. We’ll come again to that. And we take the long run view. We construct our index portfolios out of corporations which can be positioned to profit from this know-how revolution over the long run. And the methodology that we make use of relies on a really self-discipline scoring, a scoring system to pick out the know-how in market leaders. It is a self-discipline weighting techniques as properly, that avoids focus, which will be very painful as we have now seen in current month for technology-centric funds. Okay, now let’s discuss robotics and a few of the developments that we’re watching. And so first I like to point out this long run efficiency chart of the ROBO index, which consists of robotics and automation corporations from world wide.

These are the very best scoring corporations primarily based on our techniques. We will transfer on to the efficiency chart right here. Thanks. And you may see right here the out efficiency over time, which can be a reflection of this ongoing know-how revolution and the exponential development of automation and autonomous techniques in just about each sector of the economic system. And you may as well see that traditionally, the drawdowns have been in that vary of 20 to 30%, and so they have introduced attention-grabbing alternatives for traders. And on the subsequent slide, you may see what we seize with the index on the left hand facet the pie chart you may see in inexperienced, the core enabling applied sciences that make autonomous techniques potential like sensing, like computing and actuation. And in blue, these are probably the most promising purposes from manufacturing facility automation to eCommerce, logistics, healthcare, meals and agriculture, and so forth. And you may see the efficiency by sector on the best hand facet.

And as I mentioned earlier, the worst performing sectors within the border have been probably the most economically delicate, primarily the economic and manufacturing facility automation shares. Now, that is attention-grabbing as a result of what we’re seeing, what our analysis is telling us immediately is that demand for manufacturing facility robotics and logistics automation is booming and the world’s main producers simply can’t sustain with demand. The truth is, that is one attention-grabbing information level right here, initially of the yr FANUC, which is a world chief in manufacturing facility robotics firm primarily based in Japan promoting everywhere in the world. FANUC was sitting on a file excessive order backlog, practically 300 billion Japanese Yen. That’s greater than double the extent of orders that that they had earlier than the beginning of the COVID pandemic. And that is additionally greater than a full yr price of gross sales. In order we head into the incomes season, we anticipate that the quarterly orders at ROBO members akin to FANUC but additionally the opposite manufacturing facility robotics corporations like Yaskawa or ABB or Teradyne, these orders will proceed to pattern up as a result of very highly effective drivers are nonetheless firmly in place.

First is the eCommerce growth. eCommerce growth is driving demand for logistics automation options. We have seen these gaining traction in new areas of warehousing in distribution operations. It isn’t simply the eCommerce corporations, however primarily the entire transportation and logistics trade that is upgrading its instruments to deal with that booming demand. The second driver that we’re seeing is the fast shift to electrical automobiles within the automotive market. And that’s pushing automotive makers in direction of a unique manufacturing strategy that’s extra modular, that’s extra versatile, and importantly that may be very intensive by way of their use of automation know-how. And the third driver is after all, the labor scarcity that’s more and more urgent. That’s placing automation on the high of enterprise leaders’ minds. Within the US, the most recent job market information means that there are greater than 1 million manufacturing jobs which can be left open in the mean time.

So shifting on, I wish to shortly contact on a few the highest performers within the quarter. It was not all down quarter. Two corporations that you could be not be acquainted with. So on the subsequent slide right here, I wish to let you know concerning the first one that’s AppHarvest. AppHarvest was up 38% within the first three months of the yr. AppHarvest is an agriculture know-how firm that’s growing excessive tech indoor farms. These are extremely environment friendly, they’re pesticide free, they’re hyper native, and so they have a really sturdy deal with know-how. It is a mannequin that has already confirmed very profitable in locations like Holland and Spain. And this inventory is in our meals and agriculture automation sub sector. It has been fairly unstable. Since they went public final yr, they’ve confronted some difficult high quality points with their first harvest. However since then, we have seen administration revising its buildup plan that was very aggressive to a extra conservative 4 farms by the tip of the yr.

And so they’ve additionally made some vital progress by way of operations and a profitable harvest. And that is what propped up the inventory within the final three month. The subsequent one is iRhythm. iRhythm was up 34% within the quarter. iRhythm is the digital healthcare firm that is behind the Zio cellular electrocardiogram machine that’s used for distant monitoring. It is a very attention-grabbing answer for sufferers liable to arrhythmias. It may be worn for weeks, and it will get smarter over time as machine studying is utilized to a really quickly rising set of cardiac information. And so iRhythm inventory is in our healthcare sub sector. It is also a member of the HTEC portfolio that Nina might be speaking about in a minute, and has continued to rise this order on the again of a really giant enchancment within the reimbursement charge for the Zio machine in comparison with expectations only a few months in the past.

And at last, I wish to current you with two necessary info concerning the ROBO portfolio. The primary one is that combination valuations for ROBO are again to pre COVID ranges. You possibly can see right here, this chart reveals the ahead value to earnings ratio over the eight plus years of life information for ROBO. And you may see that we’re again round 25 occasions, which is only one level above the long run common, that’s 24 occasions. And that is additionally the extent that we had been buying and selling at in 2019 and the low twenties for a lot of the index historical past. And I feel that means that a number of the valuation danger that was embedded within the index a number of months in the past is basically gone. Now, the second indisputable fact that I wish to depart you with is that ROBO shouldn’t be targeting excessive flying costly shares. No. It is fairly the alternative.

ROBO is diversified. It is diversified throughout quick rising corporations and in slower rising decrease a number of shares as properly. You possibly can see right here, that is the distribution of valuations for the 81 holdings. And there actually are solely 14 out of 81 that I feel may very well be characterised as a really excessive development and excessive a number of with a gross sales a number of above 10 occasions. And these are corporations like AutoStore that is primarily based out of Norway that makes some turnkey options to automate warehouses. It is rising very quick, greater than 70% gross sales development yr over yr. You may discover shares like Nvidia, AppHarvest that I simply talked about, or Intuitive Surgical that has extraordinarily excessive margins and a really excessive recurring income parts. After which on the different finish of the spectrum on the left hand facet, you may see that there are practically as many shares with a gross sales a number of under one.

And so in reality, in case you have a look at ROBO by way of the prism of funding elements, the standard funding elements, you may see that ROBO scores excessive on high quality. And the overwhelming majority of corporations within the ROBO index are very worthwhile. The truth is, there’s only some exceptions to that and solely a handful of shares to that aren’t but worthwhile, however have a really clear trajectory in direction of profitability over the subsequent yr or so. And so with that, I’ll go it on to Nina to debate healthcare applied sciences. And I wish to remind everybody which you could ask your questions. We’ll get again to Q&A on the finish of the decision. Please use the Q&A field. All proper, thanks. Nina.

Nina Deka:

Thanks Jeremie. So I am right here immediately to speak to you about HTEC’s quarterly efficiency. HTEC is ROBO World’s healthcare know-how and innovation index, and it’s comprised of world class greatest in school healthcare know-how corporations throughout a variety of sub sectors. Let me begin with efficiency. The HTEC index posted a loss this quarter of 16%. This underperformed the NSCI world index, which was a return of detrimental 5.4% and it additionally underperformed the S&P world healthcare index, which returned detrimental 3%. So comparable elements which have been pressuring development shares akin to rates of interest rising, provide chain constraints are additionally impacting healthcare know-how equities. The truth is, additionally the Omicron wave on the finish of final yr and into Q1 of this yr additionally had a detrimental influence on a healthcare trade typically as a result of it did trigger delays in procedural volumes.

It additionally additional exacerbated the already critically low ranges of workers within the hospitals. Numerous nurses and medical doctors had been out sick in Q1, and in order that additionally led to a delay in procedural volumes and affected person care. So underperforming the broader marketplace for the quarter, however we do remember that it is a sturdy long term play. And in case you had been to have a look at a 3 yr return, you’d see that HTEC is definitely outperforming each the world equities, in addition to the S&P world healthcare index. In the meantime, the underlying fundamentals stay sturdy of the index. HTEC has a median ahead 12 month development of income of 13% and over half of the portfolio is money optimistic. In order traders search publicity to extra steady worth oriented funding alternatives throughout these occasions, HTEC the portfolio provides a really enticing composition of funding alternatives by way of danger publicity.

The truth is, over half of the portfolio is comprised of huge cap shares and embody a few of the most longtime greatest in school know-how leaders of healthcare corporations like Boston Scientific, Edwards Life Sciences, Illumina, Intuitive Surgical, Jeremie talked about earlier. These corporations have sturdy steadiness sheets and earnings development potential, and so they can climate the storm of logistical and provide chain complexities in addition to value variability. So we simply wish to guarantee that it is clear to everybody that though it is a healthcare tech portfolio, it does embody a number of corporations which can be fairly steady and long run market leaders. And no matter what is going on on on the earth, all of the macro elements that we have mentioned, the demand for brand new and higher therapies and higher diagnostics shouldn’t be slowing down, which bodes very properly for all the healthcare know-how and innovation portfolio.

It is at present buying and selling at 5.4 occasions ahead 12 month EV gross sales. And that is considerably at a reduction from a ties of seven occasions EV gross sales in 2020, 2021 in reality, and it is also down from This fall the place it was buying and selling at 6.4 occasions subsequent 12 month EV gross sales. So we have got a fairly compelling entry level proper now into the portfolio. And I simply wished to additionally make word that regardless of a interval of a number of macro uncertainty, the HTEC members proceed to make notable advances through the quarter. For instance, an organization referred to as Glaukos. That is an ophthalmic medical know-how firm that is centered on the remedy of eye ailments. I feel there is a slide on that. And I wished to level out that Glaukos returned 30% through the quarter. In case you have a look at the picture, what we’re is without doubt one of the smallest identified implants into the human physique on the earth out there in medical know-how.

That is the iStent and Glaukos is a market chief of this machine. iStent is used to deal with glaucoma. So glaucoma is mainly an eye fixed illness that places stress and damages the optic nerve, and may finally result in blindness. And ophthalmologists will strategy the remedy of glaucoma with many various kinds of therapies. They may put a stent in to assist aid stress, they could prescribe eyedrops. And so Glaukos is basically breaking spherical right here on increasing past their market main stent know-how into a few of these different methods of treating glaucoma. For instance, the attention drop which will be very tedious. It requires a affected person to place eyedrops of their eyes a number of occasions a day, and plenty of occasions sufferers aren’t compliant, they overlook or it is simply annoying and so they do not wish to do it. So Glaukos is growing one thing referred to as iDose that may allow one time implant of drops that may slowly launch eyedrops over probably a full yr interval.

So this might assist decelerate the development of the illness and assist individuals preserve their eyesight for longer. And they also anticipate to probably have this FDA cleared within the subsequent couple of years. And that is simply one of many many issues of their very wealthy pipeline. Vertex, one other firm, returned 18% in 1 / 4. So Vertex is understood for the remedy of cystic fibrosis, and they’re increasing past uncommon ailments into ailments that cowl a way more substantial measurement of inhabitants. Through the quarter, they progressed one in every of their medicine into section two three to deal with a kidney illness, which has a a lot bigger market than cystic fibrosis. They’re additionally engaged on progressing know-how in diabetes. They simply employed a famend diabetes specialist to return work at their group. So we anticipate some nice issues to be popping out of Vertex within the subsequent three to 5 years and it is a actually thrilling time to be concerned with this firm.

After which if we simply zoom again out and have a look at our sub-sectors as an entire HTEC is comprised of 9 totally different sub-sectors. You may see them on the best right here, on the left excuse me. Medical devices is our most closely weighed sub-sector. And it was the very best performing sub-sector within the quarter. So it is roughly greater than 1 / 4 of all the portfolio. And it’s comprised of a few of these corporations I discussed earlier like Edwards Life Sciences, Boston Scientific. So you may see that it was the very best performing sub-sector, as a result of it is a time the place, like I mentioned, a number of traders are migrating to these actually steady worth oriented shares. And our medical instrument sub-sector is fairly closely weighed there. And firms, even throughout a tricky quarter, proceed to make progress.

For instance, Dexcom, the innovator of the continual glucose monitoring machine, it’s the smallest machine and most correct one, and so they simply launched their seventh era of this machine in Europe through the quarter. So this has been a protracted awaited technological development. This machine is the scale of a nickel. And the thought is that as a result of it is so small and so correct and it is anticipated to be very extensively out there, sufferers can get it very simply by way of a pharmacy, that this’ll compete straight with Abbot’s Libre and probably convey much more share to Dexcom. So a number of thrilling issues taking place within the medical instrument house. The worst performing sub-sector in HTEC was the genomics sub-sector. It is a sub-sector that returned detrimental 33% within the quarter. And I consider we have now a slide on them. It is simply actually stating that genomics is a really unstable set of corporations.

And but the businesses within the genomic sub-sector, they’re fueling probably the most proliferating themes in healthcare tech. So when individuals discuss precision medication, when individuals discuss early illness detection, illness prevention, all of this in innovation that is taking place with the pharma corporations with biotech, cannot be completed with out diagnostic checks within the genomic world. And these are the businesses which can be enabling that. So themes like liquid biopsy, the place you may draw blood from a affected person and see whether or not or not they’ve most cancers cells floating round of their blood. It is a a lot simpler strategy to detect most cancers than really performing a surgical process and doing a tumor biopsy. It is a new manner that can be utilized to display individuals for most cancers that perhaps probably a affected person is at excessive danger as a result of a genomics take a look at was completed on them and so they noticed that they had been a provider of a sure gene.

So that is the way in which of the long run, the place persons are going to have way more info, the price of sequencing the genome is continuous to return down. And with all this info, we will develop extra exact checks to deal with very particular sorts of illness. And we’re already seeing a number of progress in that within the most cancers house. So corporations like Natera for instance, had a big pullback within the quarter. They needed to be a settlement to a competitor for a transplant product of theirs for the promoting. However this continues to be a market chief in prenatal testing, and one of the revolutionary corporations in genomics. And so different corporations which have had pullbacks are simply largely shifting as a bunch in response to the market.

That is like if traders are migrating towards extra worth oriented corporations the place we see a heavier presence in our medical instrument house, they’re additionally shying away from a few of these different corporations that had an enormous run over the past couple of years. And genomics is one in every of them. Genomics had an enormous run. Some corporations had been doubled in inventory worth over the past couple of years. And actually, this sub-sector has pulled again 54% from its highs in February, 2021. However that being mentioned, the underlying fundamentals are intact. These corporations proceed you to see sturdy demand, and we anticipate to see a compelling stage of demand over the subsequent decade for issues like liquid biopsy and spatial biology know-how. A lot extra to return on this house in a really enticing entry level.

Genomics contains 13% of the entire HTEC portfolio. So it is certainly not all the portfolio. And again to what Jeremie was saying earlier concerning the range that we see in ROBO, we additionally see range within the HTEC portfolio. So you are going to have a mix of excessive development names that a few of which aren’t but worthwhile after which you are going to have a number of steady corporations as properly which can be we slower rising however rising earnings. And over time, we anticipate them to proceed to keep up their market management. So all that, I’ll cease there and go this alongside to Zeno to speak about THNQ.

Zeno Mercer:

Thanks, Nina. So yeah, immediately I’ll cowl what occurred in THNQ this previous quarter. In order an introduction for many who are new and a reintroduction, THNQ offers a complete steadiness and world publicity to each infrastructure, the picks and shovels if you’ll, and as properly to recreation altering purposes of AI in our on a regular basis lives. 2021 was a file breaking yr for a lot of causes for AI, complete funding highest than ever e book private and non-private adoption is greater. The variety of AI patents had been 30 occasions greater than in 2015. Throughout this previous quarter, we’re seeing numerous new product bulletins from corporations like Nvidia and the likes, that are going to see coaching prices go down, coaching time go down and this simply places issues into an accelerating reiterative cycle of improved merchandise and {hardware} and software program that may go into our lives.

Through the quarter, the THNQ index was down 15.33%. Most of this was analysis contraction from an earlier 2021 excessive of 11 Ford EV gross sales. We’re now , and as of immediately, a 6.6 EV gross sales charge. So this comes throughout 1 / 4 once we had 80% of the THNQ index members beat earnings and income expectations, and a yr the place over three quarters of corporations within the index are anticipated to publish a optimistic EPS. And including to that additional general earnings and sale estimates have general been revised upwards for the subsequent 12 months. So what we’re seeing right here is really valuation contraction in a market and thematic space that’s accelerating. So in case you have a look at the three yr efficiency we had, or we will say that actual fast we’re nonetheless within the early innings right here. I imply, congrats in case you’re right here. Not solely is AI reworking conventional industries, however as a further driver, we’ll see a number of potential trillion greenback markets up right here that THNQ index corporations present publicity to akin to autonomous automobiles, the metaverse and extra.

Shifting to the subsequent slide. So I discussed earlier, we have now a balanced weighting to each of those, and I actually imply it. We have got 50-50 break up kind of to purposes and providers in addition to core enabling infrastructure. So there have been a number of questions coming by way of across the influence of inflation on an AI portfolio. And the fact is exterior of semi and cloud, which is definitely in some methods benefited from provide chain disruptions. I imply, not with the ability to ship it, however simply extra so the demand is greater than ever from these a number of industries. Numerous AI corporations do not essentially have provide chains. They’re inherently digital first. And they also’re really capable of present deflationary stress offering quicker options, higher merchandise and issues that throughout their respective industries are bettering profitability and higher services and products to clients, 24/7 automation and availability, extra personalised experiences.

And this is essential within the face of excessive labor prices and more and more aggressive markets. I wished level out additionally that 64% of members of THNQ are internet money optimistic. Barring no matter occurs they’re all relative in good place. Semiconductor may very well be dealing with some close to time period challenges and a number of this has been priced in already. There are a pair experiences popping out of a possible brief time period demand or dip and decelerate. A few of that is provide chain points inflicting individuals to rethink orders, however what’s necessary right here is, I’ll spotlight a current White Home report, the shortage of provide chain disruption to semiconductor took a full level off the GDP in 2021. So that is so important that there is going to be elevated funding.

Not solely that, governments world wide are urgent for heavy, heavy funding into localized chip manufacturing and manufacturing. That is within the US, that is in Europe and the remainder of the world with a whole bunch of billions of {dollars} price of CapEx anticipated to return by way of over the subsequent decade. So this isn’t slowing down. I imply, in case you’re fascinated by getting out now, that is a really short-sided time period for a semiconductor, which is basically the core physique offering all of those different experiences. On the detrimental facet, we had eCommerce struggling its worst quarter since inception. Digital retail is without doubt one of the quick rising developments. Cell and web market penetration may be very excessive. eCommerce continues to be comparatively very low. The pandemic clearly picked that up for a lot of causes, however we now have a variety of our corporations in eCommerce and AI enabled which can be really buying and selling under or round their pre COVID valuation ranges from a ahead EV gross sales perspective, at the same time as their market share capabilities and operations have improved considerably. As a fast instance, our worst carry out of the quarter Shopify, which is a number one enabler of worldwide commerce with a full service out of the field on-line platform, they supply stock administration, funds, provide chain options.

There even have made some acquisitions and so they’re trying to additionally present two day supply to as much as 90% of the US inhabitants to assist corporations compete with Amazon. Their high line is anticipated to develop even immediately 30 to 36% over the subsequent a number of years to being a $10 billion income firm. So there’s been an enormous pullback, which I feel is an effective worth alternative for a few of these corporations.

Onto the subsequent slide. So one in every of our greatest performing sub sectors right here is community and safety. For some individuals this may very well be apparent, however cybersecurity is basically I feel a misunderstood class and an space. Some individuals see it as only a sunk value or issues like that. However in case you suppose it, any operation that’s price worth within the historical past of humanity has needed to have a safety infrastructure round it. I imply, that is core to it with the ability to be functioning. As increasingly of our know-how is straight interfacing mechanically with AI, our digital banking, digital property, issues like that, cybersecurity throughout each the enterprise stage, shopper and authorities property is sustained to spend. I imply, we mainly take with no consideration our potential to entry web providers and purposes, and that our information is not essentially being hijacked or issues are going fallacious. While you order an Uber, you are anticipating that that Uber is definitely the Uber coming and that there is not danger related to that.

Numerous that’s as a result of these platforms use corporations like this that assist guarantee that there are not any vulnerabilities within the service they’re offering. And cybersecurity is anticipated to develop 15 to 25% KEGA over the subsequent decade. So it is a very quick rising trade. And a current IBM report reported that AI enabled cyber safety decreased the price of cyber safety breaches by as much as 80%. That features each misplaced enterprise because of decreased buyer confidence and direct prices akin to precise damages and lawsuits, issues like that. Onto the subsequent slide. One of many spotlight are two quarterly index leaders for THNQ. They’re really fairly comparable corporations. They’re each enabling software improvement and monitoring a lot like a automotive has a techniques board the place you recognize what’s taking place, digital know-how is a dwelling, respiration, and all the time chain platform with vulnerabilities and connections to the remainder of the world.

So Splunk was up 28% for the quarter. So Splunk offers cloud primarily based operational insights from corporations information, mainly customers and builders and leaders to get perception and see what’s taking place throughout the corporate and mainly proactively implement and forestall points. Income is up 20% yr over yr to only over $900 million, which really beat expectations by 125 million, that is for the fourth quarter reporting this previous February. In addition they have a brand new CEO Gary Steele, and he was the founding CEO of Proofpoint, which was a former THNQ member that was acquired for over $12 billion this previous yr. So we had been very assured and blissful that he’s operating the corporate now. And curiously, a non-public fairness agency, Hellman Freeman disclosed a 7.5% stake earlier within the yr. So there are a number of attention-grabbing actions taking place with Splunk which can be all optimistic.

The opposite firm I am highlighting is Alteryx, which offers finish to finish information science and analytics for enterprise corporations serving to automate and perceive processes. They supplied re-up steerage of 30% for the yr of yearly recurring income whereas sustaining a really spectacular 90% gross margin alters has been investing closely of their know-how. In January they introduced the acquisition of Trifecta for 400 million, which is an clever information visualization instrument that helps builders collaborate. So the core spine of bettering is making investments. So that they’re in a extremely good place to proceed increasing right here. Subsequent slide I wish to deal with all our new addition for the quarter. So Ambarella’s really been in our ROBO index. So we do not have that a lot overlap too usually, however that is one the place it was a no brainer so as to add at this cut-off date to the THNQ index.

So Ambarella develops semiconductors for digicam definition video compression in picture processing. So it is utilized by 9 out of 10 of the highest safety digicam corporations on the earth. And more and more, and that is the place issues are getting attention-grabbing, they’ve gone from growing for human view and evaluation to extra AI enabled. So not solely is their {hardware} and software program that they supply AI enabled and AI pushed, however they’re now being utilized by autonomous automobiles, safety cameras which can be doing autonomous scanning of potential points in site visitors and issues like that. So there are a number of actually attention-grabbing performs for Ambarella and so they’re primed to be an important half for the sting use circumstances of AI over the approaching decade and we’re excited to have them in. At this level, we’re off to Q&A so I will depart it at that.

Jeremie Capron:

Thanks, Zeno. Thanks, Nina. So we have now lot of questions coming in, and I feel we’ll begin with the query round European publicity within the three portfolios. It is positively related given the disaster in Europe proper now. I might begin off by saying that in the case of robotics and automation, there may be some publicity to Europe. It is round 20% of the portfolio so it is fairly underweight relative to a world equities index typically. And the businesses that you’re going to discover in Europe are sometimes from Germany or Switzerland, the place you may discover some corporations which have the excessive engineering expertise to fabricate a few of the key parts that go into robots. We additionally discover some logistics automation corporations there. So by way of ROBO, the publicity’s round 20%, and I will let Zeno and Nina remark for HTEC and THNQ.

Nina Deka:

I feel there’s about 11% of HTEC corporations which can be primarily based in Europe however the world range is sort of giant by way of income. So there’s a number of healthcare know-how and innovation corporations startups which can be primarily based within the US so it’s a US heavy portfolio with 80% of the shares company headquarter in the USA. We have got 4% in Switzerland, 3% within the UK, after which 1% right here and there. And so we have got some diagnostics performs DiaSorin in Italy, in addition to Roche in Switzerland. So very various income publicity, however not as various geographic breakdown by way of company headquarter.

Zeno Mercer:

Yeah, I will go for THNQ now. So from a geographical perspective, we nonetheless consider the US has many of the good AI corporations deployment and market measurement. And as such, we have now round 70% of the index is US primarily based and many of the income is us centered, however that is anticipated to extend or, I imply, decreased improve relying on the way you have a look at it. These corporations are increasing internationally and so they’re getting used internationally. So we do have publicity to China. We now have publicity to Israel, Taiwan, Taiwan semiconductor. So there are necessary corporations which can be in the remainder of the world, and that is why we do not preserve a geographic exclusion for the THNQ index.

Jeremie Capron:

Okay, thanks. Subsequent, we have now a pair questions round sensitivity to inflation and better rates of interest. And I feel that is a extremely necessary query. We predict rather a lot about that. Look, the upper charges actually have an effect on the cashflow discounting mechanism, the upper the rate of interest, the decrease the worth of future money flows. And so what we have seen available in the market over the previous six to eight month can be a vital response to the rise in rate of interest expectations, in what I name a few of the most speculative areas available in the market. So these are the businesses which have primarily new earnings and even shedding some huge cash proper now, however which can be anticipated to generate vital money flows sooner or later far into the long run. Now, the excellent news is that we do not have a number of publicity to these sorts of corporations and that is by design.

That is actually embedded within the index building methodology, the place we search for corporations which can be know-how and market leaders. And in lots of circumstances, these translate into sturdy monetary efficiency THNQ reality margins, excessive return on capital. So you may discover the overwhelming majority of corporations within the ROBO index, within the THNQ index are already very worthwhile. And firms which can be at present loss making are the exception reasonably than the norm. Now we did see a number of compression. Clearly we have talked rather a lot about it on this name. In Q1 specifically, we have now 15 to twenty% compression in analysis a number of, however in case you have a look at the place we stand and at present we’re again at historic averages. So is there additional draw back on valuations? Presumably. However is there rather a lot, I might say I doubt it. Now I wish to let Nina and Zeno remark across the profitability of the holdings in HTEC and in THNQ is a share of the entire portfolio so that you get a way of the place we stand proper now.

Nina Deka:

About 31, 32% of the HTEC corporations have detrimental earnings on a ahead 12 month foundation. So about two thirds of the portfolio is worthwhile by way of internet earnings after which the remaining names aren’t but worthwhile however do present a pathway towards profitability and all of them have income. Chances are high if they aren’t worthwhile but, they most likely have excessive development charges and so they’re investing fairly closely into the expansion of the quick rising market alternatives that lie forward.

Zeno Mercer:

And I did contact on this through the name earlier, however THNQ index members, we have now 75% which can be saying anticipated to publish optimistic EPS this yr.

Jeremie Capron:

Thanks. Okay. I see some questions round our course of on funding course of, the index building course of. There is a query across the quarterly rebalancing. I feel that is an important traits of the ROBO World indices. In contrast to the overwhelming majority of indices on the market, our portfolios aren’t market cap weighted. The weighting system relies on an inner scoring that we do for each firm that touches on our thematic areas of curiosity. And so we search for corporations which have the very best in school know-how which have a confirmed observe file of innovating and staying on high of their class by way of bringing new services and products to market and corporations which have a excessive market share or quickly increasing market share. And this scoring will decide the burden of the place within the index. And so on the finish of the day, you find yourself with place sizes of anyplace between 0.8% on the backside and as much as 1.8 or 2% on the excessive finish.

And what occurs is that each quarter we rebalance the index and the portfolio. Which means we return to that rating pushed weight. And that implies that mechanically the index might be promoting the very best performing shares over the previous three months and it is going to be shopping for the worst performing ones as we have now this embedded mechanism whereby you’re shopping for low and you’re promoting excessive. Now that creates some churn within the portfolio. And I see a query across the effectivity from a tax perspective. And we’re not right here to offer tax recommendation, however definitely index investing and that sort of quarterly rebalance has confirmed very environment friendly from the investor perspective. And that is additionally the case with the ROBO World indices. I additionally see a query round how totally different the ROBO World indices are from what you discover elsewhere available in the market. And I wish to let Zeno and Nina remark round that. I feel in the case of healthcare applied sciences, we have seen a number of curiosity round genomics specifically. So Nina, perhaps you may remark across the differentiation right here.

Nina Deka:

Positive. Nicely, I feel one key attribute is that we use a modified equal weighting methodology. And so in case you had been to have a look at all the securities within the HTEC portfolio, there’s about as an instance 85, give or take, on any given quarter. Nobody safety contains greater than a pair p.c of all the portfolio. We do have a really proprietary scoring system that we use on each single firm, not simply within the portfolio, however within the industries through which we analysis. And primarily based on that rating, an organization will both qualify and get into the index or if it winds up struggling a downgrade, say they’ve misplaced market share or they don’t seem to be maintaining with know-how and so they’re being outpaced by rivals, they could get downgraded on the rating. And if the rating does not preserve our minimal threshold, it will get kicked out.

I convey that up as a result of relying on the rating, an organization may need barely extra closely weight than others. Some are perhaps lower than a p.c and a few are perhaps nearer to 2%. So that’s one distinctive attribute of the HTEC portfolio. Nobody firm, if it has a nasty quarter or a nasty yr goes to convey down the entire portfolio. And so we have got that diversification going, after which we do rebalance that on a quarterly foundation. So that you may discover a number of different indexes that may rebalance on a semi-annual foundation and we do ours quarterly. And that’s attention-grabbing to notice, notably in a HTEC, due to the volatility in a few of the corporations as I mentioned. Genomics for instance, a really unstable set of shares, and there is a number of ups and downs. However the factor is that in case you have a look at it over time, we do anticipate that over an extended time period that ultimately it should carry out and truly as of diversified portfolio outperform is our purpose that is all people’s purpose, proper?

However so we’re utilizing the diversification to assist easy the trip if you’ll, due to the volatility. And so if there may be for instance, a bunch of corporations which can be out of favor proper now, I discussed genomics, however one other one is regenerative medication. There’s simply not a number of procedures taking place proper now. There’s not as many burns as there have been previous to the pandemic. There’s not as a lot trauma damage as a result of individuals hadn’t been doing as a lot sports activities for a pair years. They weren’t snowboarding as a lot, they weren’t touring as a lot, there weren’t as many automotive accidents. And so a few of the sub-sectors in healthcare have taken a backseat, however these are those which can be going to bounce proper again when issues return to regular. Issues like there was a slowdown largely within the genomic house of most cancers testing, as a result of individuals weren’t going to the physician, they weren’t going to the hospital, they weren’t getting recognized with most cancers.

However the illness has not slowed down. And the quantity of people that get the illness, there isn’t any motive why there could be fewer of them impacted. So we do anticipate in some circumstances that there is even going to be a backlog. So by having diversified publicity, not simply to at least one space like genomics or telehealth or simply biotech, we provide the diversification as a result of at any given cut-off date, there may a sub-sector outperforming or underperforming. And likewise a number of these corporations allow one another to progress. Our course of automation sub-sector is one that’s distinctive to our portfolio. You won’t discover that in a number of different healthcare tech portfolios, and that is comprised of a number of the businesses that helped corporations like Moderna and Pfizer for instance, get their vaccine into the arms of a whole bunch of tens of millions of individuals. Third social gathering analysis and improvement organizations manufacturing medicine, surgical robotics. So our diversified publicity might be one of many key components of what makes HTEC distinctive.

Jeremie Capron:

Zeno, do you wish to touch upon the AI portfolio and the way it differs from what else is available in the market?

Zeno Mercer:

Sure. So I do wish to soar in and begin by saying that any firm we add to our index or any of our indices, we have now long run conviction in each from firm fundamentals itself but additionally from the person developments that we’re seeing and what we really consider might be basically recreation altering know-how that might be carried out and closely invested and closely used. So that you may see another funds that have a look at AI for instance, which can be actively handle for instance. And so they say they’ve long run conviction, however they’re buying and selling out and in. And it is not essentially a long run perception, however they’re attempting to play a recreation. I feel that we have seen a unload in our index this yr to date, however as I discussed earlier, these are extremely highly effective developments which can be coming by way of.

I imply, autonomous automobiles are taking place. Proper now the one barrier is time and regulation and each of these are most likely inevitably going to be surpassed. And that requires funding, not simply from the vehicles, however coaching information facilities. There’s a lot occurring inside this factor that lots of people do not take into consideration. And we really attempt to seize all of the, as I discussed, picks and shovels that go into that. And so it is not now essentially like which particular firm goes to win on the entrance finish, and we do have a few of these corporations like Tesla, however extra so we have now enabling applied sciences that may proceed to iterate and enhance and supply different corporations the possibility to achieve success and be very pivotal and seize the upside whereas being extra diversified themselves. So I feel that is one of many methods we differ is simply that long run conviction and getting the best picks and shovels that may have the publicity, large upside potential, however they’re additionally being utilized getting money movement, getting income and more and more necessary.

Throughout our purposes I imply, we have now a healthcare portfolio, however a number of these healthcare corporations are utilizing AI now in numerous methods to enhance. I imply, biotech simply bettering the trial course of. Numerous these items require investments in cybersecurity, investments in several areas to even allow us to be half potential. You’ve eCommerce, simply the way in which that people devour and buy items and providers is increasingly being pushed by predictive analytics and AI from each giant corporations, in addition to individuals such as you and me that could be making distinctive services or products for somebody on-line and with the ability to match that mechanically enhance the addressable market, automated checkout. There’s so many various areas that require funding to offer a extra frictionless society, which is the place we’re headed.

I imply, one in every of our thesis is that AI is offering a extra frictionless expertise for everybody, extra personalised, and this is not going to reverse. It is not like we have seen the sunshine and we’ll flip round. I imply, the market may need accelerated forward of itself in 2021, which really equally is how crypto had a peak in 2017, which that peak now may be very, very small in comparison with the place the market’s at now, which is 2 trillion. So on an analogous boat, you’ve large markets that are not even realized but. And that is simply it’s a must to preserve that in consideration while you’re that. However I feel the necessary issue is to just remember to aren’t simply choosing, throwing a dart and hoping {that a} particular, random small cap autonomous car goes to make it, however getting the businesses which can be going to win it doesn’t matter what occurs. And I feel that is an necessary factor to think about in case you’re fascinated by investing over a medium, long run interval.

Jeremie Capron:

Okay, properly, we’re on the high of the hour, so I wish to thank all people for becoming a member of us immediately. I see we have now a number of extra questions. We’ll get again to you straight. I wish to remind everybody that we do share a few of our analysis on a biweekly foundation in an e mail publication which you could signal as much as on the web site at roboglobal.com. And with that, I wish to want all people an excellent day and we sit up for speaking to you once more very quickly. Goodbye.

Nina Deka:

Thanks all people.

[ad_2]