[ad_1]

Don’t be surprised once I let you know this. However, you possibly can’t belief each monetary advisor on the market. I imply there actually are individuals on the market like Matthew McConaughey’s character in “The Wolf of Wall Avenue” conducting some actually soiled enterprise.

The truth is, in response to one examine, 7.3% of monetary advisors in america have been cited for abuse. If you happen to dig deeper into the info, although, one in 12 monetary advisors within the U.S. has been cited for misconduct.

”This stuff aren’t frivolous,” Mark Egan, an assistant professor of finance at Harvard Enterprise College and a co-author of the examine, instructed Forbes. “The common settlement is in extra of $100,000 and the median is $40,000. These are pricey offenses.”

Unbelievable, proper? The very last thing that you’d anticipate is {that a} monetary advisor would embezzle cash or get you wrapped up in a Ponzi Scheme. However, so far as I’m involved, most of those monetary planners are doing a superb job. Not a tremendous job. However, an honest sufficient job the place they’re not scamming their purchasers.

So, how will you discover a reliable advisor from one who doesn’t have your greatest curiosity at coronary heart? Or, even worse, are straight-ups stealing from you?

The Fiduciary Obligation

First issues first. Let’s discuss fiduciary responsibility.

“All monetary advisors are held to an ordinary of care when coping with traders,” explains Robert Pearce, P.A. “Registered monetary advisors have a better fiduciary responsibility to their purchasers underneath the Funding Advisers Act of 1940.”

The very best degree of care have to be offered by monetary advisors, together with making acceptable investments and offering related info to their purchasers.

“Understanding whether or not your monetary advisor is registered with the U.S. Securities and Change Fee (SEC) or a state securities regulator is essential as a result of if the advisor breaches the fiduciary responsibility, you possibly can deliver a declare towards the monetary advisor by means of the Monetary Business Regulatory Authority (FINRA),” provides.

The FINRA regulates advisors and their corporations and assists advisors and traders to settle disputes.

What’s Their Planning Strategy

Shifting on, right here’s one evident pink flag to be looking out for.

Think about, as an example, that they make a suggestion to alter one thing in your portfolio. However, you don’t totally perceive it. Are they doing so as a result of they genuinely need you to extend your incomes potential or lower your danger degree or diversify extra? Or, is it as a result of it’ll assist them line their pockets extra — which clearly doesn’t profit you.

Whereas it’s solely truthful that each you and the advisor generate income, you don’t need this to occur at your expense.

Right here’s a real-life instance. A while in the past, we had some buddies who knew that I used to be a monetary planner and so they needed my opinion on one thing their monetary planner had advisable.

Mainly what this advisor was telling them was that they need to take nearly all of their present investments which had been mutual funds, and we’ll speak extra about which form of funds they need to take as that is essential to the story.

In different phrases, they had been suggesting shifting their mutual fund portfolio right into a extra managed portfolio. As I discussed earlier than, I’ve already been across the block just a few occasions, so I get the sensation that once they say managed, they’re going to cost extra.

I’d advise you to be cautious of a monetary planner’s solutions. In the event that they make the suggestion of adjusting or placing collectively a portfolio utilizing the phrase managed or managed, meaning there may be going to be a price related to it.

Why’s {that a} large deal?

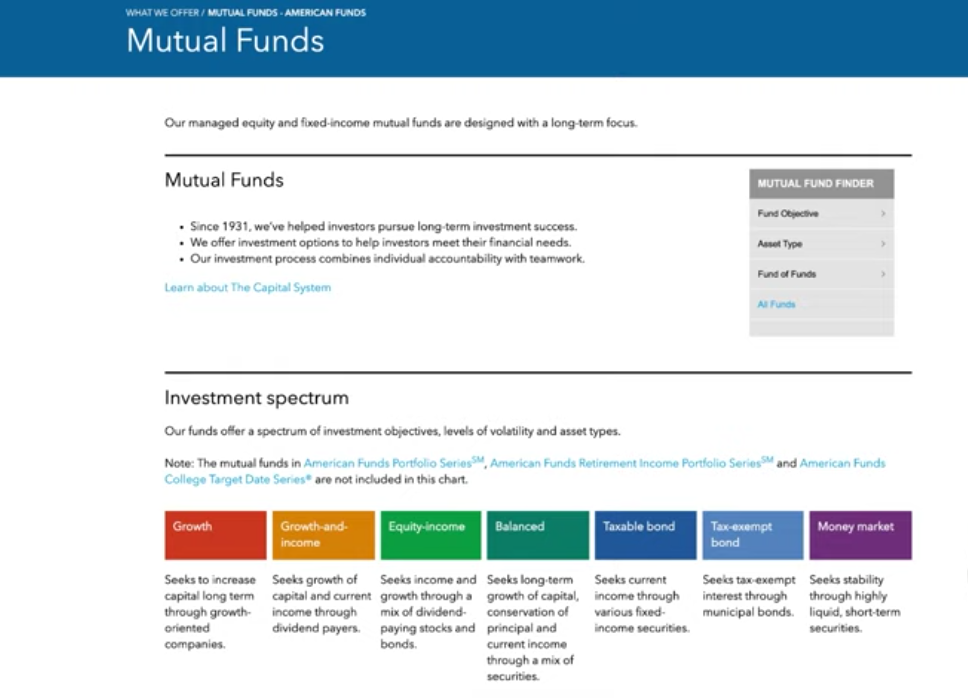

Having one thing that’s managed correctly isn’t essentially a foul factor, On this case, although, the purchasers of the advisor had been investing with a mutual fund portfolio managed by American Funds.

As you possibly can see, that is only a mutual fund firm. American Funds is one in all a number of mutual fund firms that exist. So, primarily, this is sort of a Vanguard or a Constancy.

It’s price mentioning that the People Fund household is a mutual fund firm urged by loads of monetary advisors for commissions. To not choose on Edward Jones, for instance. However anytime I checked out Edward Jones’ assertion from anyone, that they had American Funds. They’re not a foul firm, only a respectable one.

Why do I say that? Nicely, when the bear market hit in 2001 and 2002, they did effectively. However, quick ahead to 2008 and so they didn’t maintain up as individuals started promoting their American Fund. However, that is what my buddies had.

A Factor Referred to as Prospectus

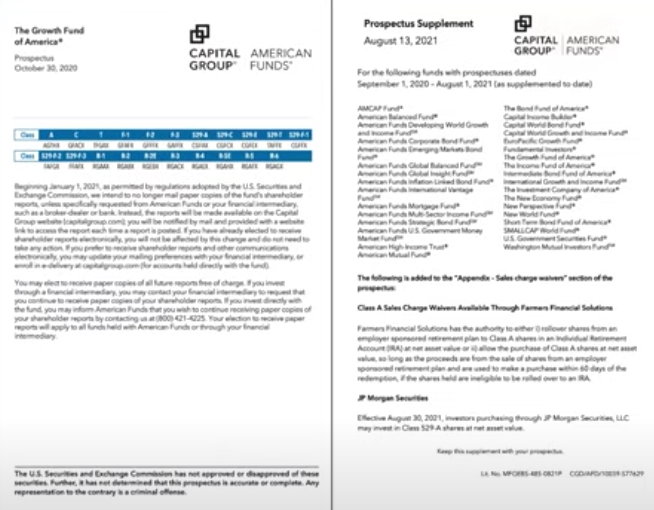

That is one in all their essential merchandise, mutual funds and that is what my buddies had. Now with any mutual fund that you just purchase, there may be this factor referred to as a prospectus.

If you purchase a mutual fund or ETF you’ll get a little bit white booklet that comprises all the pieces that it’s important to know and don’t have to fret about. They do that to stop you from taking authorized motion towards them should you lose cash. Backside line.

In different phrases, you get a prospectus. Usually, your advisor ought to mail you one. After which you’ll obtain one yearly or each time there are updates.

As a part of my coaching on tips on how to promote mutual funds, this was one of many issues that we truly used. So I assume I should put this on the market, I’m principally bashing and criticizing different people who find themselves promoting A-shares. By bashing, I imply declaring that these are advisors who’re making commissions.

To make clear, I used to be skilled in the best way I promote mutual funds and specifically, A shares, from the second I entered the enterprise. As a mutual fund salesman, I’ve at all times been taught to promote front-loaded funds. As a part of the prospectors, the shopper was proven how a lot they need to anticipate to pay in addition to what the prices had been.

The A-shares are the mutual funds the place you should buy totally different share courses of the fund. It’s common for individuals to purchase A shares or to promote them to their purchasers by means of their monetary advisors, and I’m going to share with you the way it works, how a lot they pay, and much more particularly, how a lot they pay that my buddies pay to buy their A-shares from American Funds.

So let’s take a better have a look at a real-life prospectus.

Right here’s an excerpt from American Funds Capital Group’s web site. I assume that that is the prospectus for The Progress Fund of America — on the time this was their largest mutual fund.

I’ll be sincere. You don’t learn all 81-pages of this. It’s so boring with a capital B. However for these of you who love the small print and need to study extra about investing with mutual funds, this booklet might help you obtain that.

To avoid wasting you a while, nonetheless, the 2 most essential issues for you to concentrate on are the A and C-shares. My buddies bought A-share. That is the most typical kind of share class to put money into if the inventory and it’s normally for longer than 5 years.

Within the prospectus, you possibly can see that there shall be a load of 5.75% of no matter you make investments. You’ll subtract $575 from $10,000 if it’s important to make investments. In case you’re , the advisor will get paid 5% of the load, with the mutual fund firm getting paid 0.75%. So if I bought you a mutual fund for $10,000, I’d receives a commission 500 {dollars}.

How Does an Advisor Get Paid

Though you’re paying now, over time you’ll be recouping these prices. With a C-share, you wouldn’t be paying something upfront. Nevertheless, you’ll pay an annual price of 1%. Since this 1% is on an ongoing foundation, you’ll find yourself paying extra in the long run.

Nevertheless, there may be a further price with the A-share cost. It’s referred to as the 12b-1 price and it’s the 0.25% that you just pay on an ongoing foundation. Along with this, there’s a administration price.

So you’ve got administration charges, distribution charges, and different bills. So whole working bills are 0.64, versus the 1.39 with the C-share. That is the place all of those charges play into the equation.

On this case, we’ve got an A-share, the place we pay a front-end load, 5.75%, and a C share, the place we don’t pay something upfront. However, then we pay a 1% ongoing price to the advisor, along with administration bills.

With regard to A versus C, if you’re an advisor and that is one thing persons are saving for retirement, then the A-share appears extra logical. How come? If you pay upfront as a substitute of ongoing, it’ll value much more with a C-share

Additionally, there’s one other distinction with mutual fund firms. Let’s say that you just make investments greater than a certain quantity. So when you have lower than $25,000 you’ll pay that 5.75 %. Consequently, should you make investments between $25,000 to $50,000 with the American Funds, then you definately get a reduction. In that case, as a substitute of paying a front-load of 5.75%, you’ll solely should pay 5%. It’s like free cash to you.

Right here’s why that is barely suspect.

The advisor almost definitely bought these A shares on the concept that the A-shares are a less expensive possibility. Once more, you’re paying upfront. And also you’re most likely getting a reduction for a way a lot you might be placing into the American Funds. That’s going to be a lot inexpensive than proudly owning the C shares which have ongoing prices.

His proposal was to remove American Funds and change this to a managed portfolio. Nevertheless, a managed portfolio means paying a better price.

So, why would the advisor make this suggestion?

First, the advisor was promoting his purchasers on the advantages of diversification. How so? Nicely, a portfolio consisting of mutual funds means that you’d personal a basket of funds. You’ll now have 12 to fifteen totally different mutual funds, as a substitute of 5 or 6.

Right here’s the place I turn into actually suspicious.

His subsequent assertion was, “I simply don’t have the time proper now to handle this portfolio.” However, why would he say that?

What this advisor is principally saying is that “I’m too busy to handle your portfolio.” In consequence, I’ve not been managing your portfolio since I bought it.

That’s an issue as a result of now he’s saying that it is best to change to the managed portfolio as a result of he doesn’t have the time anymore. That’s along with an upfront price that’s most likely between 2 ½% and three ½% on a steady foundation. And, there are additionally annual administration bills, that are like 0.65% per 12 months.

In consequence, shifting to a extra diversified mutual fund portfolio means extra administration bills.

It’s due to this that that is borderline shady. The advisor should assess your administration price everytime you transfer to a managed portfolio? Oftentimes, you’ll hear about fees-based, fee-based advisors. The charges they cost are primarily based on the belongings they handle.

In the event that they caught with the primary portfolio, they acquired paid upfront. After that, they acquired paid 0.6 after which they acquired paid 0.25% ongoing. However, let’s say underneath portfolio two the advisor expenses a 1% administration price. it doesn’t embrace the 0.65%. So that you, the shopper, must pay for your complete 12 months 1.65% of the whole portfolio worth.

A 1.65% price could be required in 12 months two. 12 months three, nothing modifications. And that is the place the advisor is making extra in the long term. Now they’re making 1% as a substitute of 0.25%.

That’s loads of math there. Lengthy story quick, although, the advisor has reached a degree the place they need to enhance the charges they’re producing on a reoccurring foundation.

To be clear, nonetheless, the advisor must report in the event that they’re making extra money. However, perhaps should you transferred corporations, you would possibly get round this.

Remaining Phrases of Recommendation

Though monetary advisors should disclose this info, they will nonetheless promote their purchasers on diversification. Nothing unsuitable with having a diversified portfolio. However, on this situation, the shopper paid a hefty upfront price on their unique portfolio. Then, 3 or 4 years later, the advisor urged that they a lot to a extra diversified portfolio. Now, there’s a bigger ongoing price and all the pieces’s being managed by a 3rd get together.

So, earlier than getting talked into this, ask the advisor what’s actually happening right here. If they’re appearing fishy, seek the advice of one other professional. Or, go to FINRA BrokerCheck and file a report. That sounds extreme. However, they’re making an attempt to double-dip by making an enormous fats fee test on the again of the entrance finish whereas making extra on the again finish. And, that’s completely not okay.

Protecting Your Cash Secure from Shady Advisors was initially revealed on Due by Jeff Rose.

[ad_2]