[ad_1]

At any time when traders imagine they’re swimming in uncharted waters, their threat of taking excessive actions rises —together with pulling their property out of the market. It’s a problem at a time when the phrase ‘unprecedented’ is being heard far too typically, referring to every thing from inventory valuations and inflation, to the US political setting and the struggle in Ukraine.

Fortunately, there’s one space the place uncertainty is markedly absent: automation. Even in these ‘unprecedented’ instances, there’s little doubt that investments and improvements in automation will proceed to extend quickly. The rationale: the shift towards larger automation has develop into a enterprise necessity as a consequence of its capability to drive productiveness and spur financial development.

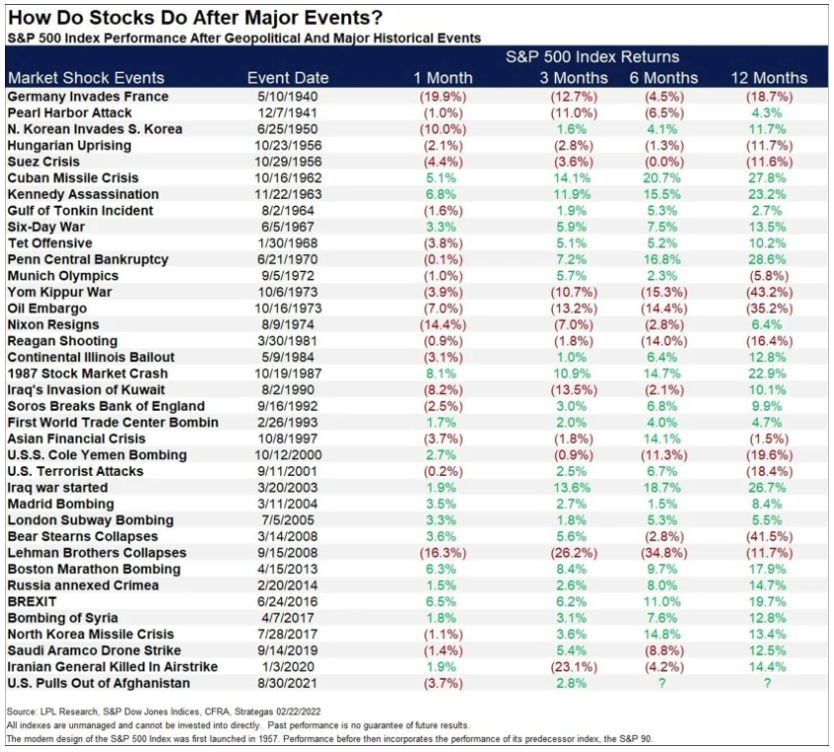

It’s abundantly clear that now could be the time to be invested—and keep invested—in automation. For these not already invested, the latest market pull-back gives a simple entry level with immense development potential. And for traders who harbor any doubts in regards to the development to return, a quick take a look at historical past can shortly put them comfortable. Whereas present occasions can definitely really feel ‘unprecedented,’ in truth, nearly each decade in latest historical past has included notable conflicts, stresses, and fears that created seemingly unprecedented circumstances for the capital markets. But, as illustrated within the chart under, the market has confirmed remarkably resilient within the face of those circumstances, offering ample returns to traders from decade to decade:

When taking a look at a number of a long time of asset class returns, it’s also clear that shares have typically outperformed nearly all different asset lessons. The S&P 500 common annualized return since its inception in 1926 by means of Dec. 31, 2021, is 10.49%. Whereas that’s not information to any seasoned investor (there’s good cause we select to spend money on shares!), you will need to word that, once we take a look at market historical past, the most important threat for traders at any time limit is solely not being invested.

Even realizing that, staying invested could be a problem as a result of, sadly, we traders are usually not as calm and rational as we understand ourselves to be. One of many inherent flaws in investor conduct is the tendency to behave on our feelings—and react to the market. It’s all too frequent for self-proclaimed ‘long-term traders’ to alter their tune as soon as the inventory market falls, selecting to withdraw their cash and run for short-term security. The hazard, in fact, is that few traders are fortunate sufficient to reinvest in time to profit from the inevitable market rebound, leaping again in solely after most new positive aspects have already been achieved. It’s this sort of reactive conduct that drives traders to purchase excessive and promote low, in the end crippling returns and completely damaging their portfolios.

For sensible traders who’re capable of overcome these feelings and keep invested by means of a down cycle, there isn’t any higher place to achieve for development than automation. Regardless of the ‘unprecedented’ occasions occurring across the globe, we see many predictive traits rising in 2022 that time to a long time of future development for automation. Over the previous few years, we’ve witnessed steady and important developments throughout the automation trade, in addition to wider adoptions, extra speedy development, and constant and improved efficiencies in practically each market sector—all because of the ability of automation. The analysts concur. Based on McKinsey, automation is now the #1 development in expertise. A Gartner survey not too long ago reported that greater than 80% of organizations plan to ‘proceed or enhance’ their spending on automation applied sciences. Enthusiasm round automation is intensifying, and we count on it to develop exponentially within the years and a long time forward. On the similar time, the disruption within the provide chain—together with the availability of labor—is creating an enormous surge in spending on robotics and synthetic intelligence. With the regulation of provide and demand at work, turning to automation to cut back labor prices and enhance productiveness is an apparent alternative.

It’s unlikely that the world round us will ever really feel calm—at the least not for greater than a minute or two. We live in an infinite cycle that appears doomed to repeat. Whereas that might not be a consolation, from an investor perspective, it does provide this upside: an ‘unprecedented’ alternative to spend money on the way forward for automation.

[ad_2]