[ad_1]

Sachin Bansal’s Navi Applied sciences, a fintech startup that gives clients insurance coverage and mortgage merchandise, has filed for a $440 million IPO because the 40-year-old entrepreneur who made his cash by kick beginning the e-commerce wave within the nation as soon as once more makes a daring selection.

Navi Applied sciences’s preliminary public providing will consist solely of recent shares, and the startup might think about elevating a pre-IPO placement, it stated in its draft prospectus filed with the native regulator Saturday.

The IPO comes at a time when tech shares – or most others – have plunged in latest months. All tech startups together with Zomato, Paytm, Nykaa and PolicyBazaar that went public final 12 months have traded at their lowest share costs in latest weeks.

However for Navi Applied sciences, which has been eyeing an preliminary public providing for greater than a 12 months, there’s additionally a way of urgency in making the corporate public. The startup’s most up-to-date try to boost cash from SoftBank and different buyers at over $4 billion valuation crumbled following its lack of ability to safe a license to change into a financial institution, based on two folks acquainted with the matter.

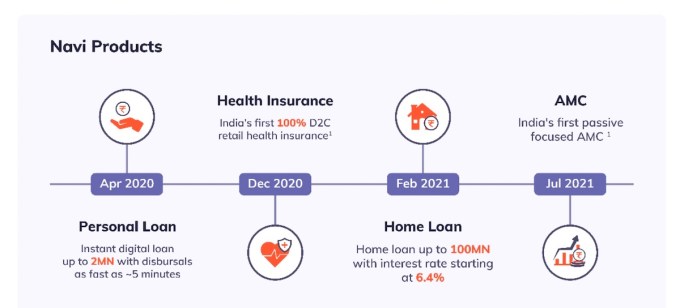

Based in 2018, Navi provides digital private loans, dwelling loans and credit score in opposition to property within the lending house. It additionally offers clients with medical health insurance and digital asset administration with a passive fund focus.

Billionaire Bansal, who co-founded Flipkart over a decade in the past and was pushed out of the corporate earlier than its sale to Walmart, and Navi have largely stayed off the limelight. The draft prospectus (PDF), for the primary time, provides colour on Navi’s numerous companies and its monetary well being.

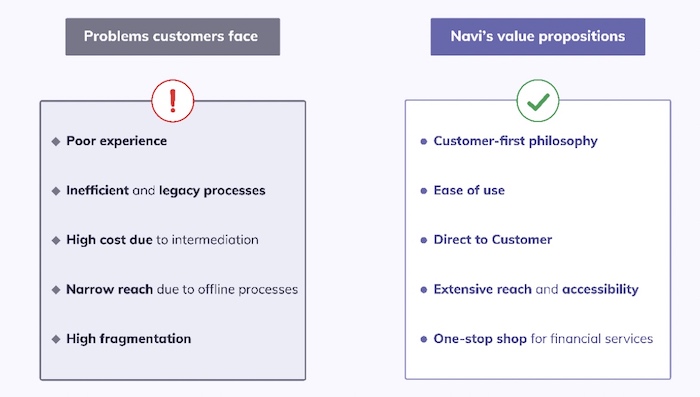

“With its in-house NBFC (non-banking lender) arm, AI/ML-based underwriting and digital-only D2C method, Navi has been capable of train management over its lending merchandise from sourcing, underwriting to the gathering and provide a easy expertise to clients,” the startup describes itself within the draft prospectus.

Navi says it’s utilizing know-how to serve clients who haven’t been served in any other case. The startup ensures “prompt mortgage disbursals, provide digital dwelling loans at low-interest charges, leverage know-how to handle fraud and credit score default dangers, use knowledge analytics to coach its lending algorithms to supply enticing pricing and higher mortgage account administration and exercising each digital and area collections to its benefit.”

Navi’s worth preposition, in its personal phrases

The startup – which has reported a consolidated revenue of $9.2 million in FY21 on income of $17.8 million – says its private lending and retail medical health insurance merchandise are serving to clients join in lower than 4.5 minutes and a pair of.5 minutes, respectively.

In 21 months since its launch, Navi’s private loans enterprise has served over 481,000 clients in 84% of Indian zip codes and prolonged 2 million Indian rupees to them with as much as 84 months of tenure. The ticket measurement of those loans is $665.

“As of December 31, 2021, 61.17% of our medical health insurance insurance policies bought had been permitted with none human help on the Navi App. Additional, we’ve developed our chat-based interface which ensures that our clients are served seamlessly all through their shopping for journey,” the startup provides.

“We provide medical health insurance premiums via EMIs, the place a buyer will pay a hard and fast quantity each month in the direction of their coverage has made our merchandise enticing and inexpensive. Through the 9 months ended December 31, 2021, our GWP was ₹667.60 million, of which ₹63.26 million was from the retail medical health insurance section. Through the 9 months ended December 31, 2021, we had issued a complete of 220,491 insurance coverage insurance policies of which 27,800 had been retail medical health insurance insurance policies.”

[ad_2]