[ad_1]

Welcome to my new weekly fintech targeted column. I’ve been publishing this each Sunday however on March 27, this column turns right into a e-newsletter! So, if you wish to have it hit your inbox immediately beginning then, enroll right here.

2021 was a file yr for enterprise capital fundraising, and fintechs had been the biggest recipients of funding worldwide, with about 21% of all enterprise {dollars} final yr going into fintech startups.

All of us knew – or at the least a few of us did, ahem – that this was seemingly not sustainable in the long run. Buyers gave the impression to be backing some startups partly as a result of FOMO, and that’s not essentially a very good factor.

In order the primary quarter attracts to a detailed, it’s clear that whereas by no means have fundraises come to a screeching halt, buyers are beginning to pump the brakes. Typically, it seems we’re experiencing a market pullback – which Alex touches on on this piece – precipitated by plenty of issues, not the least of which – the battle in Ukraine and disappointing performances by corporations who went public within the final yr. And fintech, final yr’s rising star of enterprise, isn’t immune.

My former colleague, Joanna Glasner, at Crunchbase Information printed a narrative on March 7 indicating that enterprise capitalists’ enthusiasm for fintech appears to be waning as of late. Her information level, based on Crunchbase information, was that within the two weeks main as much as her publish, a complete of 51 fintech corporations throughout the globe collectively had raised $1.1 billion in seed by means of late-stage enterprise funding. That was down about 63% from the prior two-week interval, throughout which 80 corporations raised simply shy of $3 billion.

Final yr, it was actually a founders’ market, which means that phrases had been extra founder-friendly than ever. Many buzzy startups had their choose of buyers and located themselves introduced with a number of time period sheets. In lots of circumstances, corporations had been elevating cash left and proper at very early phases, with little greater than a deck, thought and staff established.

One founding father of a really fast-growing fintech startup specifically, who I can not but identify till his firm’s upcoming spherical is introduced (keep tuned), informed me Friday that when elevating for a spherical in early 2022, he noticed a giant distinction within the “stage of diligence” on the a part of buyers than he noticed in 2021.

“Final yr, even for us, it was like, ‘take a look at this gorgeous graph, we’re rising so rapidly,’ ” he remembers. “And everybody was like, ‘yeah, that is sensible, let’s make investments on this.’ ”

This yr, then again, there have been extra questions on margins, operations, income coming in – what the contribution was like on every, he added.

“We went by means of the entire gauntlet in January and February,” he informed me. “That’s why, truthfully, this increase feels very satisfying.”

In speaking with different founders, he realized that they had been experiencing comparable issues.

“It’s a fully completely different surroundings from This autumn of final yr,” he mentioned, “not simply when it comes to the extent of diligence but in addition, within the entry to capital. Whereas there’s nonetheless loads of dry powder, it’s not as simple to get it on the precise phrases you wish to get it because it was once.”

And in his view, and mine fairly frankly, that’s not a nasty factor.

Founders having to supply tangible proof of a sound enterprise mannequin with actual numbers makes extra sense than, as he put it, “Hey, take a look at these fairly issues. Give me a verify for that.”

To not preserve tooting our personal horn, however the Fairness staff late final yr predicted this may occur. Selfishly, for the sake of my inbox (and sanity!), I’m all for buyers being extra discriminating on the subject of which corporations they resolve to again. And for the founders who’re in a position to increase in a more difficult surroundings, it also needs to – as within the case of the aforementioned founder – really feel extra rewarding after they do shut on these fundraises.

Observe: After all on this loopy startup world, issues change week by week, and my good friend and fellow fintech fanatic Nik Milanovic shared in his personal e-newsletter on Saturday that “52 (52!) fintech corporations raised $2.76 billion. A file for the variety of funding rounds and near the file for many funding raised by fintech in a single week.” I’m ready to see what first quarter numbers appear to be and even higher, second quarter numbers. There’s all the time a lag so fundings being introduced now have seemingly been within the works for a short while.

Oops, Higher.com did it once more

I’m as weary of writing about Higher.com as you most likely are of studying about it. However I’d be remiss to not embrace point out of the occasions of the final week, which included my breaking the information concerning the firm’s mass layoff of about 3,000 individuals. Astonishingly, after a fiasco of a December layoff that affected 900 individuals, the digital mortgage lender managed to botch issues once more. Affected staff shared that they discovered that they had been getting laid off when a severance verify randomly appeared of their payroll app, after which was mysteriously eliminated. Lengthy story quick, the corporate had deliberate to conduct the layoffs one on date, modified their minds presumably as a result of a leak after which forgot to replace the timing of when the severance checks would exit. It was a mistake that may have been forgiven if the corporate had not royally screwed up its December mass layoff by conducting it coldly throughout a Zoom name.

I want to clarify that as any aggressive reporter, I like getting scoops as a lot as the subsequent journalist. Nevertheless, scoops on mass layoffs are by far the least enjoyable to get. It sucks that so many individuals have misplaced their jobs at this firm prior to now few months. And whereas market situations (rising rates of interest which have led to fewer re-financings, amongst different issues) absolutely performed an element within the resolution, it could be silly to not surmise that the extreme hit to its fame must be impacting Higher.com’s means to win new prospects searching for to buy houses and thus, its general enterprise.

Backside line: sooner or later, any firm could have to put off staff. However there’s a huge distinction in dealing with it with compassion and respect than in dealing with it in a method that offends not solely the workers themselves, however even informal observers. And for proof of the latter level, one want want look no additional than the feedback on my posts on LinkedIn and Twitter.

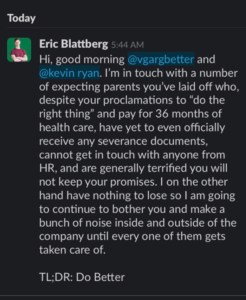

After I wrote all the above, I got here throughout a LinkedIn publish from a Higher.com worker who on March 11 was requested to resign per week early after publishing an inside communication from the corporate on social media. Senior product designer Eric Blattberg publicly pushed his employer — together with immediately speaking with CEO Vishal Garg and CFO Kevin Ryan on LinkedIn and Slack — to supply further severance pay and prolonged insurance coverage advantages to the anticipating mother and father who had been being laid off. The corporate reportedly pledged to supply these staff prolonged COBRA advantages for 12 months, as reported by Bloomberg.

Picture Credit: Eric Blattberg

His expertise illustrates Higher’s efforts to make itself look higher (he was requested personally by Garg to publish the corporate’s transfer on social media), the frustration that a lot of its former staff really feel and what accountability seems like. At the least Higher — on this case — pledged to do the fitting factor.

As of March 12, there have been stories of the prolonged advantages not amounting to 12 months as promised. In accordance with Blattberg, who posted the next on LinkedIn:

Higher is including to its string of company incompetence right this moment with written agreements to anticipating mother and father that differ from what a Higher lawyer studying from a script promised them in a telephone name, based on two of the anticipating mother and father who famous the disparities to me earlier right this moment. Within the telephone name with the laid-off staff, the Higher lawyer promised 4 further weeks of severance pay and 12 further months of paid COBRA premiums on high of the usual bundle supplied to all laid-off staff, bringing their medical health insurance protection to the tip of June 2023, the anticipating mother and father informed me. However in an e-mail subsequently acquired by the anticipating mother and father, the COBRA protection was solely 9 further months, bringing their protection to March 2023, and there was no further severance pay supplied. In a subsequent communication with one of many anticipating mother and father described to me this morning, the lawyer admitted to creating a mistake, complicated the 20 days of prolonged severance supplied to all fired staff as further pay of their customized bundle, however declined to honor the prior dedication. That is, as traditional, unacceptable. Higher ought to #DoBetter.

I reached out to Higher.com and a spokesperson despatched me a hyperlink to the unique letter despatched to staff on March 8 however declined to reply to any questions relating to medical health insurance advantages, citing privateness issues.

Through DMs, Eric informed me: “On Tuesday morning I discovered myself in a novel place of privilege: nonetheless inside Higher because it casually fumbled the layoffs it had spent months planning, inflicting an unfathomable quantity of collateral harm, however not petrified of dropping my job, since I used to be sitting on a proposal from Ergatta, the place I’ll begin as a senior product designer March 21… My solely purpose this entire time has been to assist individuals. I don’t wish to tear the corporate down, I wish to defend the workers Vishal has tossed apart like they had been simply numbers on a stability sheet. They don’t seem to be only a quantity. Each one in every of them has their very own story, their very own well being care journey, their very own cause for working at Higher. They usually deserve a lot extra respect, consideration, and help than they acquired this week. So I’m going to maintain combating on their behalf from the surface.”

SPAC is a four-letter phrase

On EquityPod this week, Alex, Natasha and I dug into the rising variety of corporations ditching their SPACs and opting to lift cash as an alternative with the newest instance being Acorn, which this week introduced it raised $300M at a virtually $2B valuation – consistent with what it could have raised within the SPAC anyway. Corporations like Acorn and Kin Insurance coverage are doing this for a wide range of causes, together with a at the moment unfavorable public market. But in addition, I feel corporations (and buyers) are realizing what a few of us already suspected – that something that’s too simple to return by might be not value having. Working example: Acorn’s CEO Noah Kerner informed me that when Acorn does resolve to go public, it will likely be by way of the normal IPO route. Thus, we concluded that SPAC is a four-letter phrase, once more.

LatAm and Africa’s maturing startup scenes

Latin America raised a file quantity of enterprise capital final yr and now we’re seeing extra indicators of an more and more maturing market. This week alone, I wrote about two corporations that had been co-founded by the founders of unicorns within the area. The primary was Mara, a a São Paulo-based startup that goals to “reinvent” the grocery purchasing expertise for the underserved in Latin America. One in all its co-founders is Ariel Lambrecht, who additionally helped begin mobility startup 99, Brazil’s first unicorn. The second was Yuno, a two-month-old Colombian funds startup which raised $10 million in a seed spherical of funding co-led by a16z, Kaszek and monashees.

Picture Credit: Co-founders Juan Pablo Ortega and Julian Nunez / Yuno

The flexibility to lift a comparatively massive seed spherical so quickly after inception speaks to the expertise of the corporate’s founders, which embrace Juan Pablo Ortega, the co-founder of on-demand supply unicorn Rappi (which as of final July was valued at $5.25 billion) and Julián Núñez, an early Rappi worker.

As Latin America’s startup ecosystem continues to develop, there isn’t any doubt we’ll solely see extra founders of profitable corporations go on to begin new ones and spend money on different early-stage startups during which they see potential.

There are numerous parallels between LatAm and Africa, which can also be seeing its startup scene develop impressively. A few of us who’ve been paying consideration view Africa at a spot at the moment the place LatAm was a number of years in the past, simply beginning to entice extra world curiosity and {dollars} – particularly in fintech startups.

In December 2021, Uganda’s multi-service and digital fee know-how platform SafeBoda turned the primary startup on the continent to obtain funding from the Google fund. It has now been joined by fintech Numida, which emerged as the primary startup within the nation to get into YC (W22). And rattling, out of Ghana this previous week, Sprint raised a $32.8 million seed spherical (huge by even U.S. requirements) led by Perception Companions, a New York-based personal fairness and enterprise capital agency, to construct “a linked pockets for Africans.”

There’s a sure vitality popping out of LatAm and Africa that’s refreshing and thrilling to cowl and I can’t wait to see what’s subsequent in each areas.

Picture Credit: Sprint

Fundings

Actually, even I used to be impressed with the variety of world fintech-related fundings printed on TechCrunch over the previous week – a testomony to the kick-ass staff of reporters we now have all around the world.

I can’t embrace all of the cool fintech funding offers that happened this final week so I’m going to slim it down to a couple from every continent together with some others that had been introduced that TC didn’t cowl for one cause or one other.

Indian fintech CredAvenue turns unicorn with recent $137 million funding

Crypto mortgage lender Milo secures $17 million funding

US paytech Stax hits $1bn valuation with $245m funding spherical

CoFi closes on $7 million seed to rework development financing

Colombia’s Acasa, a “purchase earlier than you promote” financing answer has US$38 million in recent funds for individuals who wish to transfer home Observe: Acasa is seemingly the primary “Purchase Earlier than You Promote” proptech firm in LatAm (like Knock, Orchard, Fly Properties and Homeward within the U.S.).

Argyle raises $55M Sequence B to “make truthful credit score decisioning potential for each lender and shopper by means of real-time, user-permissioned entry to employment information”

Capchase closed an $80 million Sequence B as the corporate seems to broaden its funding platform that gives founders non-dilutive financing options. The brand new spherical was led by 01 Advisors.

In different information

Zeta, a SoftBank-backed supplier of next-gen bank card processing to banks and fintechs which turned a unicorn final Could, and Mastercard on March 7 introduced a 5-year world partnership. As a part of the settlement, the businesses mentioned they are going to go-to-market collectively to launch bank cards with issuers worldwide on Zeta’s “fashionable, cloud-native, and absolutely API-ready credit score processing stack.” Mastercard additionally invested within the firm as a part of a $30 million increase that took the corporate to a $1.45B valuation, based on the Financial Occasions.

TripActions, which was targeted on journey however has since expanded into company spend and expense administration, gave me a sneak peek on the launch of its new providing, Auto-Itemization, which t says leverages synthetic intelligence and machine studying “to robotically assign particular person line objects on a receipt to expense classes after which applies firm coverage to every line merchandise.” This transfer is yet one more instance of how the company spend house is getting more and more aggressive. I additionally wrote this previous week a few new startup referred to as Glean AI, which describes itself as “accounts payable with a mind.”

Quite a few tech corporations have joined the rising record of tech manufacturers which are suspending their operations in Russia amid its invasion of Ukraine. The most recent batch of corporations doing so contains a number of notable names, together with monetary providers corporations akin to PayPal, Mastercard, Visa and extra.

Airtel mentioned on March 7 it’s launching a bank card, the newest try from the Google-backed Indian telecom operator to make inroads with monetary providers because it seems to broaden its choices on the planet’s second-largest web market.

Klarna’s earnings inform us, writes Alex, that the BNPL market continues to broaden, with shoppers blissful to transact an increasing number of with the spending mannequin. In addition they present us that progress in BNPL land isn’t low cost; Klarna’s working prices are scaling quickly and the corporate’s profitability is struggling.

On March 9, Public introduced that it had bought Otis, a startup that permits shoppers to purchase and commerce fractional shares in particular person various property.

Portage Ventures introduced the $616M shut of its third fund, which it claims to be one of many largest early-stage fintech funds worldwide.

Jerry jumped into the auto mortgage refi house. We coated the startup’s final increase – a $75M spherical at a $450M valuation – final August.

And final however not least, I wrote about how Credit score Karma, Betterment and Austin-based startup Chipper need to supply scholar mortgage debtors with some aid choices.

Properly, that’s it for this week. Please word that I’ll be out subsequent week, having fun with spring break with my household so there might be no column printed on March 20. However my e-newsletter formally launches on March 27 so when you haven’t subscribed but, now could be the time!

Take care and be protected!

[ad_2]