[ad_1]

Decarbonization of on-road transportation, together with vehicles, buses and vehicles, is nicely underway, with electrical alternate options not solely broadly accessible however reaching 9% of all passenger automobile gross sales in 2021.

One other sector of transportation is far farther behind in electrifying and can change into a bigger piece of the emissions pie as emissions from on-road autos fall. That sector is off-road autos, tools and equipment utilized in development, mining, agriculture and ports.

Off-road autos and tools are main contributors to air pollution, accounting for nearly three-quarters of effective particulate matter (PM) and one-qua of nitrogen oxides (NOx) emitted from cell sources within the U.S., and one-quarter of PM and >15% of NOx in Europe.

Emissions requirements and in-use compliance for off-road autos and tools lags heavy-duty on-road vehicles and passenger vehicles, and there are some key variations that may making lowering emissions from off-road autos totally different than on-road autos:

- Off-road autos and tools embody a variety of sizes, weight and capabilities and are characterised by low quantity and decentralized, creating limitations to carry down prices by means of economies of scale and meet required performance.

- Off-road industries, significantly ports and development websites, are extra delicate to air high quality and air pollution considerations than CO2 emissions, as ports and development websites are sometimes situated close to city facilities and deprived communities. Current emissions rules goal PM and NOx emission, reasonably than CO2.

- Resulting from larger prices of low- and zero-emission tools, lack of regulatory pull for many industries, and infrastructure challenges, demand for innovation within the off-road sector is low.

Agriculture

Low- and zero-emission agriculture tools, primarily tractors, is in very early levels of deployment. Incumbent tools producers, comparable to John Deere and Agco, have launched electrical tractors in recent times, and electrical tractor startups, comparable to Solectrac and Monarch tractor, have emerged. Passion farms and small business farms with a sustainability-focused model and sustainability-conscious customers which can be prepared to pay a premium for merchandise produced with inexperienced practices are driving demand for electrical tools. Due to the upper upfront value of electrical tractors, giant business farms will want rules and/or subsidies to stimulate demand.

Along with the next buy value of the tractors themselves, charging infrastructure is without doubt one of the major limitations to deploying electrical tools. Farms are usually not giant customers of electrical energy and sometimes situated in rural areas, making it costly and tough to construct out electrical infrastructure for charging.

Development

Though development and agriculture have many similarities, comparable to overlapping equipment and parts producers, the development sector has made extra strides in electrifying tools. One key driver for that is that whereas farms are usually situated in rural areas, development websites are sometimes situated nearer to inhabitants facilities, the place the noise and air pollution is concentrated right into a smaller area and impacts extra folks instantly. Municipalities trying to cut back the noise, air pollution and emissions from development are presently driving electrification efforts. For instance, 40 cities all over the world have signed on to the C40 Clear Development Declaration, which requires procuring and, when attainable, utilizing solely zero-emission development equipment from 2025 onwards. Some cities, like Oslo, have already created zero-emission development zones.

Charging infrastructure can be a significant problem for electrical development tools. Development websites are usually momentary and will be area constrained, making it tough to spend money on on-site charging and fueling infrastructure. One other main problem is getting adequate electrical energy to a website, as development is basically reliant on diesel-powered turbines.

Mining

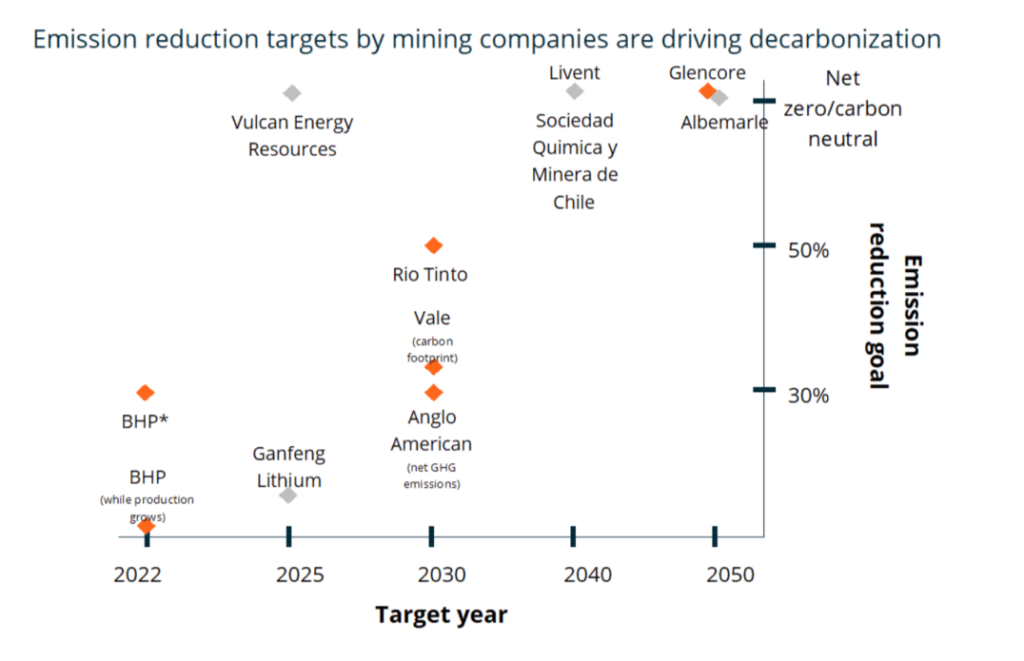

Rising demand for important minerals and metals and provide chain transparency initiatives have led to mining coming beneath elevated scrutiny to scale back emissions. Many main mining firms have made commitments to scale back emissions by means of 2050. Low-emission industries comparable to renewable vitality and electrical autos rely closely on uncommon earth metals, and Life-Cycle Assessments (LCAs) of those applied sciences has created extra demand to decarbonize your complete provide chain.

Nevertheless, mines have lengthy lives, long-term provide contracts and rely upon reliability and predictability. Thus, mining firms historically have been conservative in adopting new know-how.

Ports

Maritime ports are seeing growing uptake of low- and zero-emission cargo dealing with tools, significantly for smaller tools like terminal tractors. Procurement mandates, rules and subsidies just like the California Air Sources Board’s (CARB) plan to transition current cargo dealing with tools regulation to zero emissions are driving the market. As well as, company commitments to net-zero emissions in Scope 1, 2 and three actions are additionally driving decarbonization. Logistics contracts should meet the wants of firms who’re committing to net-zero operations and want to cut back emissions all through their provide chain. One other driver is e-commerce progress and port growth. Huge progress in house deliveries throughout the pandemic will seemingly proceed, resulting in port growth and elevated emissions at ports. Resulting from proximity to city areas, port progress is prompting environmental and emission discount initiatives to keep away from group pushback and opposed well being results of accelerating emissions.

Innovation

Emissions discount rules and demand for zero-emission tools in off-road industries lags on-road industries. Nevertheless, zero-emission options from incumbents in off-road industries are additionally lagging on-road industries, creating a chance for innovators to realize an early movers’ benefit within the coming years as demand will increase for zero-emissions tools.

Gridtractor is a California-based supplier of agricultural vitality providers to handle electrical load from irrigation pumping and electrical tools, spun out of Polaris vitality providers. In November 2021, the corporate launched a fleet electrification SaaS platform, together with charging know-how, vitality administration and vehicle-to-grid (V2G) providers, for electrical tractors. Gridtractor’s goal is to bridge the hole between conversion to electrical tractors and grid-integrated autos. The as-a-service enterprise mannequin includes promoting an electrification plan to farmers, proudly owning the tractors and managing autos, vitality and batteries. This enterprise mannequin permits versatile use of tractors (they are often transported to the place demand is highest) and minimizes prices for farmers.

Zeus is a developer of a purpose-built, modular versatile chassis for Class 3-8 electrical vehicles. An preliminary validation truck has been in use for one 12 months and 5 extra vehicles are presently being constructed. The corporate’s strategy includes a custom-made, floor up and customer-driven design. Autos use a typical chassis, however the battery will be adjusted to accommodate totally different auxiliary capabilities to attenuate upfitting prices and maximize versatility.

ClearFlame Engine Applied sciences is a developer of combustion engine know-how that permits diesel engines to run on decarbonized different liquid fuels. In October 2021, ClearFlame raised $17 million in Collection A funding from Breakthrough Power Ventures, Mercuria Funding, John Deere and Clear Power Ventures. The funding shall be used for commercialization with demonstration vehicles on the street by the tip of 2022, in parallel with agricultural tools and generator set deployments in 2022. Enterprise mannequin contains aftermarket retrofits (for on-road autos) in addition to licensing to OEMs (for on- and off-road autos).

[ad_2]