[ad_1]

Kyash, a Tokyo-based cellular monetary app, has raised $41.2 million (4.9 billion JPY) Collection D funding.

The spherical comes from various traders together with Japan Put up Funding Company, Block (previously often known as Sq.), Greyhound Capital, SMBC Nikko Securities, Altos Ventures, Goodwater Capital, StepStone Group, JAFCO Group, Mitsui Sumitomo Insurance coverage Capital and others.

In line with a report by Nikkei, this marks Block’s first funding in an Asia-based firm. The Collection D brings Kyash’s whole funding to roughly $107.7 million (12.8 billion JPY) since its inception in 2015.

The startup will use the proceeds to double its headcount and bolster product development, Shinichi Takatori, chief govt officer of Kyash, advised TechCrunch.

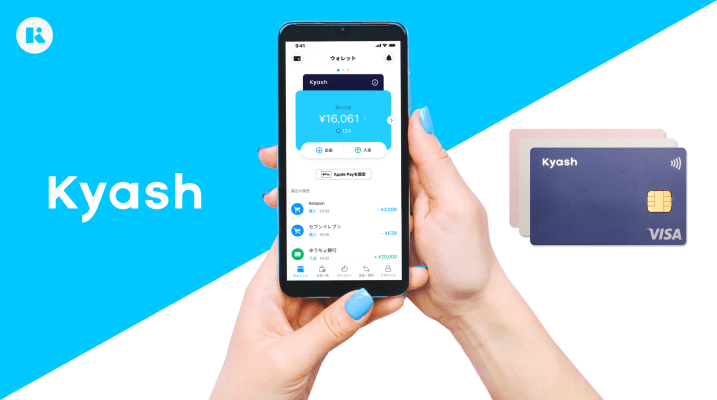

Based by Takatori, who beforehand labored within the banking and consulting business, Kyash presents a cellular banking app that allows shoppers to make on-line and offline funds, remittances, and ATM withdrawal providers. As well as, Kaysh, the issuer of Visa Card, gives flexibility by issuing digital and bodily pre-paid debit playing cards. When requested about its B2B enterprise, Kyash has carved out its white-labeled card issuing platform to infcurion final 12 months and is targeted purely on direct channel enterprise, Takatori mentioned in an interview with TechCrunch.

Takatori mentioned Kyash at present focuses on the Japanese retail market, which is the third-largest economic system globally, including that it could think about abroad enlargement within the mid to long run. The corporate has obtained two licenses – pay as you go debit playing cards license in 2020 and fund switch license in 2017 – from the federal government to function its monetary providers in Japan.

“We now have achieved unit economics optimistic already, which is a really optimistic issue for traders to contemplate funding,” mentioned Takatori, who didn’t present the variety of customers and whole addressable market.

With social distancing being enforced globally in the course of the COVID pandemic, cashless funds have gotten the norm. Accordingly, the pandemic has impacted international challenger banks’ development charges. Based mostly on a report by Fincog, Kyash additionally grew about 22% from January to Could 2020 like different opponents, Robinhood and Starling Financial institution. (Kyash additionally raised $45 million Collection C in March 2020 in the course of the pandemic.)

“Challenger Financial institution is a core theme in fintech and unbundling of conventional banking has develop into an irreversible development globally,” mentioned Takuma Baba, managing director of Japan Put up Funding Company. “We imagine Kyash’s user-first and mobile-first philosophy and product structure will permit it to evolve right into a key platform upon rebundling the monetary providers with know-how.”

“JAFCO made the primary funding in Kyash earlier than the service was launched, and this spherical marks its fifth funding,” mentioned Atsushi Fujii, accomplice at JAFCO. “We imagine that the corporate will take an additional leap ahead and develop into a frontrunner within the subsequent technology of finance.”

“We’ll proceed to develop our enterprise by creating new alliances and growing collaborations and garner additional belief from our prospects,” Takatori mentioned.

[ad_2]