[ad_1]

Simply as Netflix and Tesla disrupted the media and automotive trade, many fintech firms are remodeling the Monetary Providers trade by profitable the hearts and minds of a digitally energetic inhabitants by means of personalised providers, numberless bank cards that promise extra safety, and frictionless omnichannel experiences. NuBank’s success story as an eight-year outdated startup changing into Latin America’s most respected financial institution isn’t an remoted case; over 280 different fintechs unicorns are additionally prepared to disrupt your complete fee trade. As famous within the Monetary Conduct Authority (FCA) examine, “There are indicators that a few of the historic benefits of huge banks could also be beginning to weaken by means of innovation, digitization and altering shopper habits.” Confronted with the selection of both disrupting or being disrupted, many conventional monetary providers establishments (FSIs) like JP Morgan Chase have just lately introduced vital strategic investments to compete with fintech firms on their very own grounds – on the cloud, utilizing knowledge and synthetic intelligence (AI).

Given the quantity of information required to drive superior personalization, the complexity of working AI from experiments (proof of ideas/POCs) to enterprise scale knowledge pipelines, mixed with strict knowledge and privateness laws on the usage of buyer knowledge on cloud infrastructure, Lakehouse for Monetary Providers has rapidly emerged because the strategic platform for a lot of disruptors and incumbents alike to speed up digital transformation and supply tens of millions of consumers with personalised insights and enhanced banking experiences (see how HSBC is reinventing cellular banking with AI).

In our earlier resolution accelerator, we confirmed how you can determine manufacturers and retailers from bank card transactions. In our new resolution accelerator (impressed from the 2019 examine of Bruss et. al. and from our expertise working with international retail banking establishments), we capitalized on that work to construct a contemporary hyper-personalization knowledge asset technique that captures a full image of the buyer and goes past conventional demographics, revenue, product and providers (who you might be) and extends to transactional habits and buying preferences (the way you financial institution). As a knowledge asset, the identical could be utilized to many downstream use circumstances, reminiscent of loyalty applications for on-line banking functions, fraud prevention for core banking platforms or credit score threat for “purchase now pay later” (BNPL) initiatives.

Transactional context

Whereas the widespread method to any segmentation use case is a straightforward clustering mannequin, there are just a few off-the-shelf strategies. Alternatively, when changing knowledge from its unique archetype, one can entry a wider vary of strategies that usually yield sudden outcomes. On this resolution accelerator, we convert our unique card transaction knowledge into graph paradigm and leverage strategies initially designed for Pure Language Processing (NLP).

Just like NLP strategies the place the which means of a phrase is outlined by its surrounding context, a service provider’s class could be discovered from its buyer base and the opposite manufacturers that their customers help. With a view to construct this context, we generate “buying journeys” by simulating prospects strolling from one store to a different, up and down our graph construction. The goal is to be taught “embeddings,” a mathematical illustration of the contextual data carried by the shoppers in our community. On this instance, two retailers contextually shut to 1 one other could be embedded into massive vectors which might be mathematically shut to 1 one other. By extension, two prospects exhibiting the identical buying habits might be mathematically shut to 1 one other, paving the way in which for a extra superior buyer segmentation technique.

Service provider embeddings

Word2Vec was developed by Tomas Mikolov, et. al. at Google to make the neural community coaching of the embedding extra environment friendly, and has since turn out to be the de facto commonplace for growing pre-trained phrase embedding algorithms. In our resolution, we’ll use the default wordVec mannequin from the Apache Spark™ ML API that we practice towards our buying journeys outlined earlier.

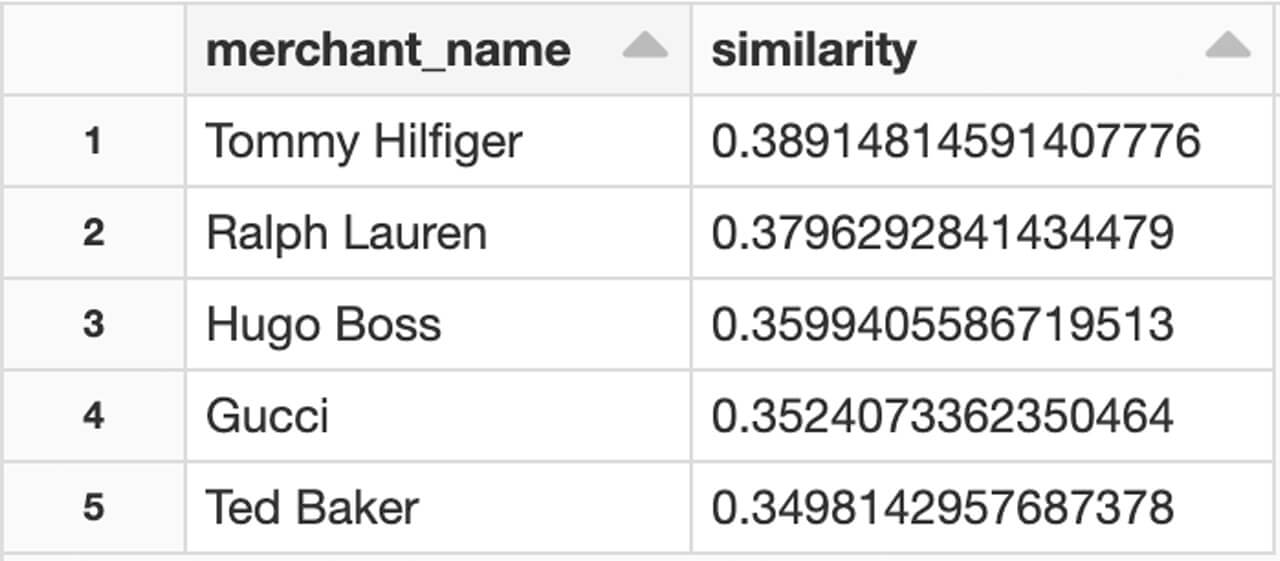

from pyspark.ml.function import Word2Vec with mlflow.start_run(run_name="shopping_trips") as run: word2Vec_model = Word2Vec() .setVectorSize(255) .setWindowSize(3) .setMinCount(5) .setInputCol('walks') .setOutputCol(vectors) .match(shopping_trips) mlflow.spark.log_model(word2Vec_model, "mannequin")The obvious method to rapidly validate our method is to eyeball its outcomes and apply area experience. On this instance of manufacturers like “Paul Smith”, our mannequin can discover Paul Smiths’ closest opponents to be “Hugo Boss”, “Ralph Lauren” or “Tommy Hilfiger.”

We didn’t merely detect manufacturers inside the similar class (i.e. vogue trade) however detected manufacturers with the same price ticket. Not solely might we classify totally different traces of companies utilizing buyer behavioral knowledge, however our buyer segmentation is also pushed by the standard of products they buy. This statement corroborates the findings by Bruss et. al.

Service provider clustering

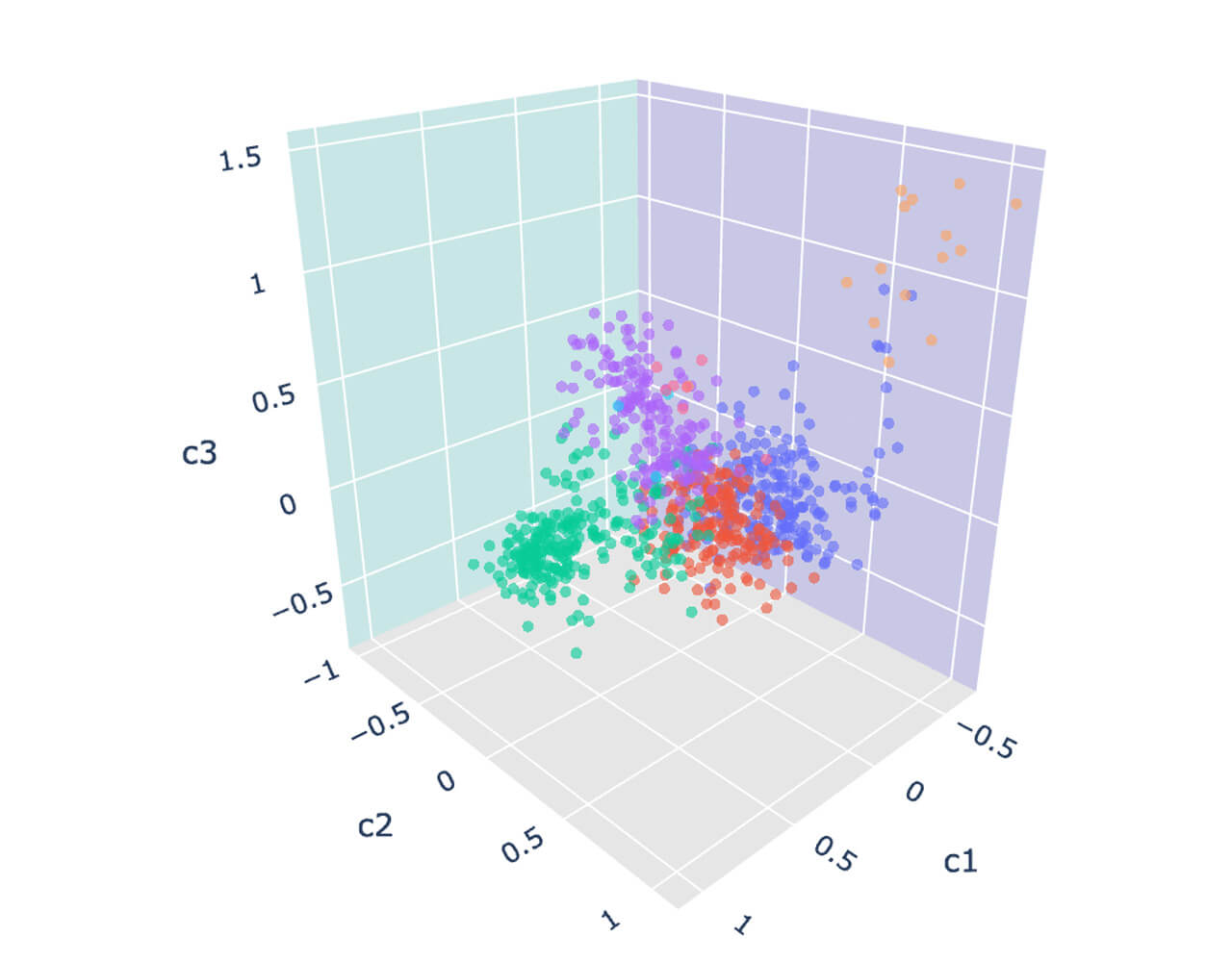

Though the preliminary outcomes have been troubling, there could be teams of retailers kind of related than others that we could wish to determine additional. The simplest method to discover these vital teams of retailers/manufacturers is to visualise our embedded vector house right into a 3D plot. For that function, we apply machine studying strategies like Principal Element Evaluation (PCA) to scale back our embedded vectors into 3 dimensions.

Utilizing a easy plot, we might determine distinct teams of retailers. Though these retailers could have totally different traces of enterprise, and could seem dissimilar at first look, all of them have one factor in widespread: they entice the same buyer base. We will higher verify this speculation by means of a clustering mannequin (KMeans).

Transactional fingerprints

One of many odd options of the word2vec mannequin is that sufficiently massive vectors might nonetheless be aggregated whereas sustaining excessive predictive worth. To place it one other method, the importance of a doc could possibly be discovered by averaging the vector of every of its phrase constituents (see whitepaper from Mikolov et. al.). Equally, buyer spending preferences could be discovered by aggregating vectors of every of their most well-liked manufacturers. Two prospects having related tastes for luxurious manufacturers, high-end vehicles and positive liquor would theoretically be near each other, therefore belonging to the identical section.

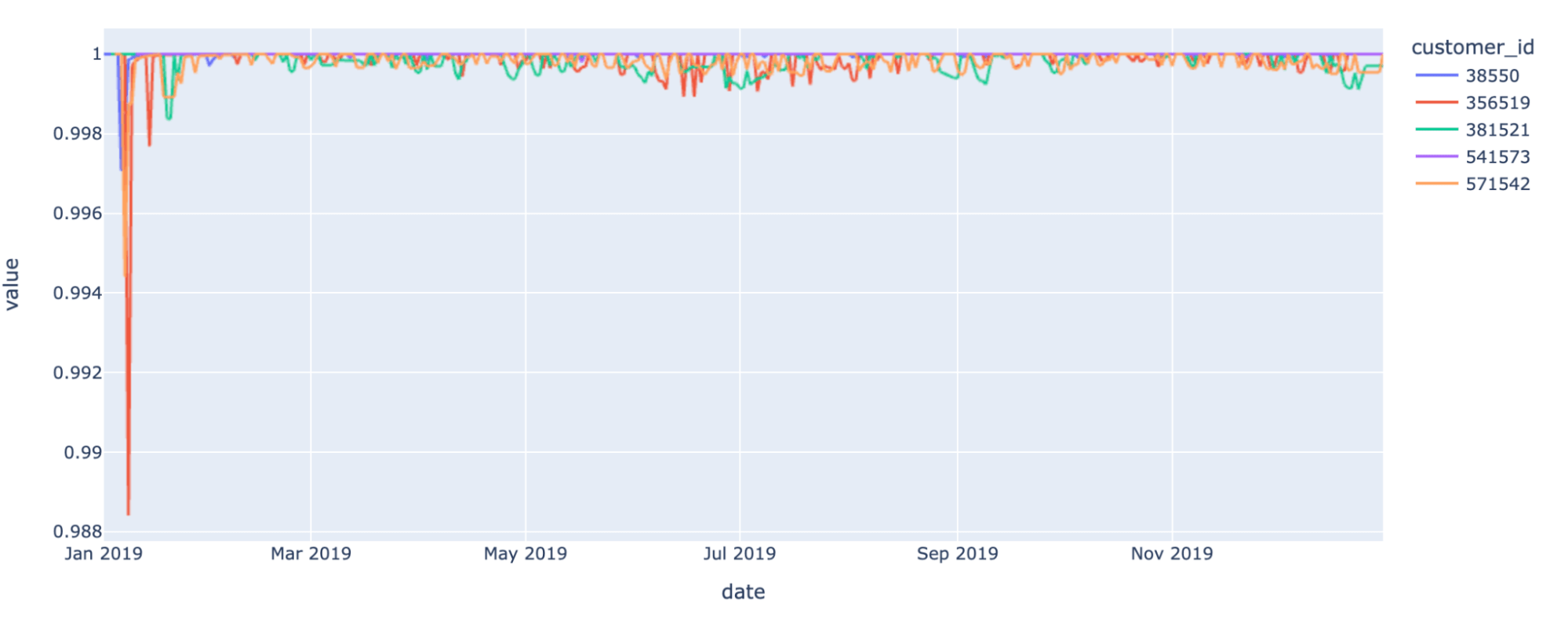

customer_merchants = transactions .groupBy('customer_id') .agg(F.collect_list('merchant_name').alias('walks')) customer_embeddings = word2Vec_model.remodel(customer_merchants)It’s price mentioning that such an aggregated view would generate a transactional fingerprint that’s distinctive to every of our finish customers. Though two fingerprints could share related traits (similar buying preferences), these distinctive signatures can be utilized to trace distinctive particular person buyer behaviors over time.

When a signature drastically differs from earlier observations, this could possibly be an indication of fraudulent actions (e.g. sudden curiosity for playing firms). When signature drifts over time, this could possibly be indicative of life occasions (having a new child baby). This method is essential to driving hyper-personalization in retail banking: the power to trace buyer preferences towards real-time knowledge will assist banks present personalised advertising and presents, reminiscent of push notifications, throughout varied life occasions, constructive or detrimental.

Buyer segmentation

Though we have been capable of generate some sign that gives nice predictive worth to buyer behavioral analytics, we nonetheless haven’t addressed our precise segmentation downside. Borrowing from retail counterparts which might be typically extra superior on the subject of buyer 360 use circumstances together with segmentation, churn prevention or buyer lifetime worth, we are able to use a unique resolution accelerator from our Lakehouse for Retail that walks us by means of totally different segmentation strategies utilized by best-in-class retail organizations.

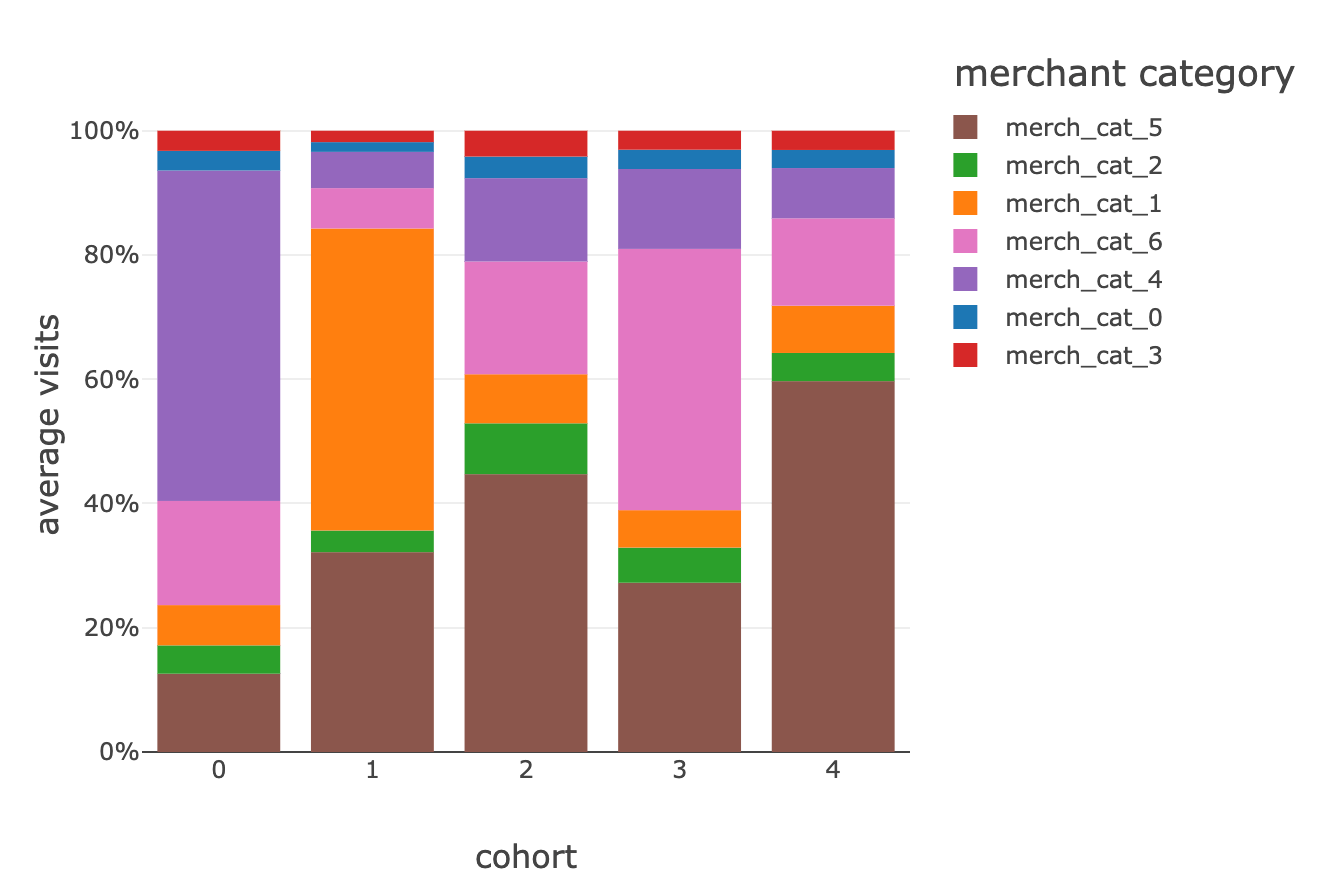

Following retail trade greatest practices, we have been capable of section our total buyer base towards 5 totally different teams exhibiting totally different buying traits.

Whereas cluster #0 appears to be biased in direction of playing actions (service provider class 4 within the above graph), one other group is extra centered round on-line companies and subscription-based providers (service provider class 6), in all probability indicative of a youthful technology of consumers. We invite our readers to enrich this view with further knowledge factors they already find out about their prospects (unique segments, services and products, common revenue, demographics, and so on.) to higher perceive every of these behavioral pushed segments and its impression for credit score decisioning, next-best motion, personalised providers, buyer satisfaction, debt assortment or advertising analytics.

Closing ideas

On this resolution accelerator, we’ve got efficiently utilized ideas from the world of NLP to card transactions for buyer segmentation in retail banking. We additionally demonstrated the relevance of the Lakehouse for Monetary Providers to handle this problem the place graph analytics, matrix calculation, NLP, and clustering strategies should all be mixed into one platform, secured and scalable. In comparison with conventional segmentation strategies simply addressed by means of the world of SQL, the disruptive way forward for segmentation builds a fuller image of the buyer and might solely be solved with knowledge + AI, at scale and in actual time.

Though we’ve solely scratched the floor of what was doable utilizing off-the-shelf fashions and knowledge at our disposal, we proved that buyer spending patterns can extra successfully drive hyper-personalization than demographics, opening up an thrilling vary of recent alternatives from cross-sell/upsell and pricing/concentrating on actions to buyer loyalty and fraud detection methods.

Most significantly, this method allowed us to be taught from new-to-bank people or underrepresented customers with no identified credit score historical past by leveraging data from others. With 1.7 billion adults worldwide who do not need entry to a checking account in accordance with the World Financial Discussion board, and 55 million underbanked within the US alone in 2018 in accordance with the Federal Reserve, such an method might pave the way in which in direction of a extra customer-centric and inclusive future for retail banking.

Attempt the accelerator notebooks on Databricks to check your buyer 360 knowledge asset technique at the moment and contact us to be taught extra about how we’ve got helped prospects with related use circumstances.

[ad_2]