[ad_1]

Funding advise and scheduled investing objectives

By way of notifications, you’ll be able to counsel an apt plan for funding to your customers. Funding choices needs to be at their disposal by means of a scheduling choice. It may be weekly, month-to-month, quarterly as per particular person spending is anxious. Thus, it will enhance the goodwill of your finance app.

Other than these options, there are some must-have options listed by considered one of our greatest fintech app builders at House-O Applied sciences who has expertise of over 8 years of in growing apps.

Options of Finest Fintech Apps

| Sr No | Widespread Options of Finest Fintech Apps |

Approx Dev. Hours iOS/Android |

|---|---|---|

| 1 | Instantaneous transfers | 24 Hrs |

| 2 | Fingerprint login | 1 Hr |

| 3 | Cellular P2P ship | 36 Hrs |

| 4 | Cellular photograph invoice pay | 24 Hrs |

| 5 | Add a brand new payee | 8 Hrs |

| 6 | Use cellphone ATM | 12 Hrs |

| 7 | Set spending limits | 8 Hrs |

| 8 | Face detection | 5 Hrs |

| 9 | Evaluate spending | 4 Hrs |

| 10 | Voice banking app | 40 Hrs |

| 11 | Chatbot in messaging | 60 Hrs |

| 12 | Add profile photograph/avatar | 4 Hrs |

| 13 | Cellular cost app integration | 10 Hrs |

| 14 | Push notification | 10 Hrs |

| Subtotal | 246 Hrs | |

If you’re planning to combine these options into your finance and banking app, right here is how one can calculate the monetary app improvement price.

Estimated Value for Growing a Finance App

The applying improvement price is majorly primarily based on which platform are you choosing and the hourly charge of the monetary app developer. For extra clear concept, we now have ready a components which offers you a tough estimation on your app.

Suppose that the cell app improvement firm is charging $30 per hour.

Apply this easy components to know the price of creating the most effective app.

Estimated Growth Hours * Developer’s Hourly Value = Complete Cellular App Growth Value

After calculating the approximate price, we’re certain you might be clear about how a lot to spend money on your utility improvement. With the choices of fintech world, financial savings and investing choices starting from digital piggy banks to buying and selling in cryptocurrencies, there are various traders eyeing on this sector.

So, why are these large investments going down within the fintech apps?

There will be presumably two solutions for this sort of trending funding within the finance sector.

- Larger Returns (for revenue technology and person engagement)

- Diversified portfolio (to broaden their enterprise in different genres)

With the diversified choices within the finance house, traders are taking a look at getting the basics proper like profitability, unit-level of economics, buyer acquisition price. Not too long ago greatest fintech firms like Robinhood has doubled its buyer up to now one yr to greater than 6 million and newcomer, Stash, debuts the listing with 3 million users- 80% of that are first-time traders.

Elevated person engagement signifies extra profitability which is accompanied by progress in buyer acquisition price and market economics for the investor’s enterprise. Thus, the finance phase choices are making traders eager to dive in and earn some breathtaking returns.

If you’re having any second ideas on growing, talk about your cell banking app concept with our app consultants. Additionally, you will get an concept concerning the present market traits, inventory market, bitcoin money, and different saving accounts in-app techniques.

Fintech Business Measurement 2020-2022

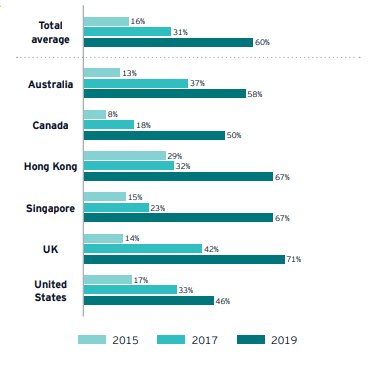

- In accordance with current statistics from Fintechauscensus, they carried out a case examine on six adaptive like Australia, Canada, Hong Kong, Singapore, the UK, the US who’ve surged from 16% in 2015 to 31% in 2017, to 60% in 2019. Thus the fintech business is an ever-growing platform.

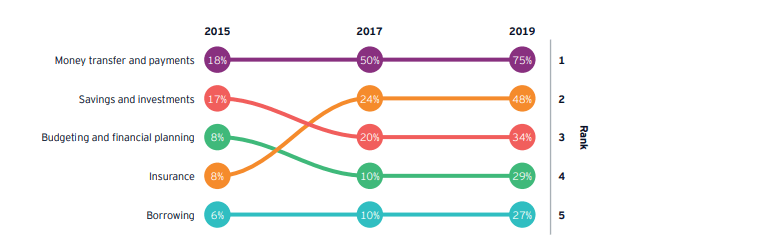

- There’s a steady progress after we see on-line monetary providers like cash transfers and funds, financial savings and investments, insurance coverage, borrowing. Herein there’s a comparability of fintech classes ranked by adoption charge from 2015 to 2019.

Steadily Requested Questions

What’s fintech firm?

Fintech is a mixture of “finance” and “know-how.” Now individuals are not strolling right into a financial institution and requesting to verify the stability. Individuals are eager to verify the data in real-time on their smartphones.

By way of the main fintech apps, fintech firms present shoppers to go surfing and see their monetary transactions.

What are the examples of fintech?

1. Crowdfunding: It’s a digital fundraising community that permits customers to obtain or ship cash through apps. They permit companies or people to conveniently use one location to pool funding from numerous sources. It’s potential for fintech startups to succeed in out to traders for help reasonably than going to a conventional financial institution. Additionally it is often called a p2p funding platform.

2. Cellular Funds: These days the trade of cash and on-line cost with a smartphone person has emerged to be some type of cell cost. In accordance with a current report from Statista, the worldwide cost market has surpassed $1 trillion in 2019. There are high fintech apps like Venmo which have made numerous distinction within the fintech financial system.

3. Blockchain and Cryptocurrency: Monetary transactions have turn out to be sooner and safer. Some cryptocurrency buying and selling platforms like Coinbase, Robinhood, have diminished prices, sooner transactions, enhanced effectivity, higher traceability, improved safety, and elevated transparency.

4. Inventory Buying and selling and Robo Recommendation: The purchasers are in a position to search monetary advisors extra effectively and at a decrease price for the inventory market. They tailor funding plans to the respondents’ distinctive attributes, together with age, threat tolerance, present debt, private belongings, and such. Apps like Vanguard, Robinhood, are the most effective fintech apps for inventory buying and selling and Robo recommendation.

How a lot is fintech value?

The worldwide fintech market was valued at $127.66 billion and is anticipated to develop to $309.98 billion at an annual progress charge of 24.8% by means of 2022. Fintech has made funds for items and providers sooner, simpler, extra handy, and cost-efficient for purchasers. Fintech has turn out to be the B2C focus, together with enterprise fashions, client views, and blockchain know-how.

What’s the greatest finance app?

There are numerous branches of the monetary service sector, thus, the most effective finance app in every of them are as follows:

- Mint: Finest Cash Administration App

- Wally: Finest Monitoring Bills App

- Acorns: Finest App for Simple Saving

- Robinhood: Inventory buying and selling and Robo recommendation app

- Venmo: Cellular Cost App

- You Want a Finances: Finest Debt App

If you’re planning to develop a finance app, it is best to positively examine the options and functionalities of those purposes.

Are cash monitoring apps protected?

There are greatest banking apps like Mint, YNAB, which can be defending their person’s priceless data by means of blockchain know-how in addition to “read-only” access- which means they’ll see monetary exercise however can’t make adjustments like switch cash with none consent. If you’re planning to be among the many greatest apps on the planet, on-line customers’ safety is a should. Make certain, your app exhibits each buy, invoice, however not any of the financial institution login knowledge. So, in any case, in case your finance administration app is hacked, he won’t be able to hack the precise customers’ financial institution accounts.

Wrapping Up

After going by means of the most effective finance apps information, we assume you could have theoretically made the appliance, able to launch. A mere concept just isn’t what makes app profitable, fixed updates with present technological alternative & market traits will allow you to keep a very long time on this hyper-competitive app world.

So, cross-verify your fintech app concepts with us as we’re one of many main cell utility improvement firms primarily based in India, Canada, and the USA. We offer the most effective iOS app improvement providers together with Android & Internet options on your finance app concepts. We now have developed cell apps for various classes. Take a look at ftcash and PayNow for Stripe apps to have a transparent concept. For a extra versatile have a look at our work, you’ll be able to go to “our work” part on our web site.

If nonetheless not happy then use these apps and take a look at them to know our expertise, till you’re feeling we’re the only option in terms of growing the most effective fintech apps.

In any case, in case you have any queries associated to the precise price of fintech utility improvement, utility improvement timeline of finance apps, greatest fintech apps design, methods to make a fintech app, how do fintech apps become profitable, get in contact with us by means of our contact us type. Certainly one of our gross sales representatives will information you thru it. The preliminary session with our consultant gained’t price you any cash.

Helpful assets

[ad_2]